50/30/20 Budget Template Excel - Needs 50% or $1990, wants 30% or $1194, savings & debts 20% or $796. Who is this budget method for? Web to start making your budget, you have to go to the source of it all: Web percentages for your budget. Web it sounds harder than it is. How do you pay off debt with a 50 / 20 / 30 budget? Web with that information, the worksheet shows how your finances compare with the 50/30/20 budget breakdown, which recommends that 50% of your income goes toward needs, 30% toward wants and 20% toward. Adjust your actual spending to fit; Follow along for a quick budget example. What budget apps work with the 50 / 30 /.

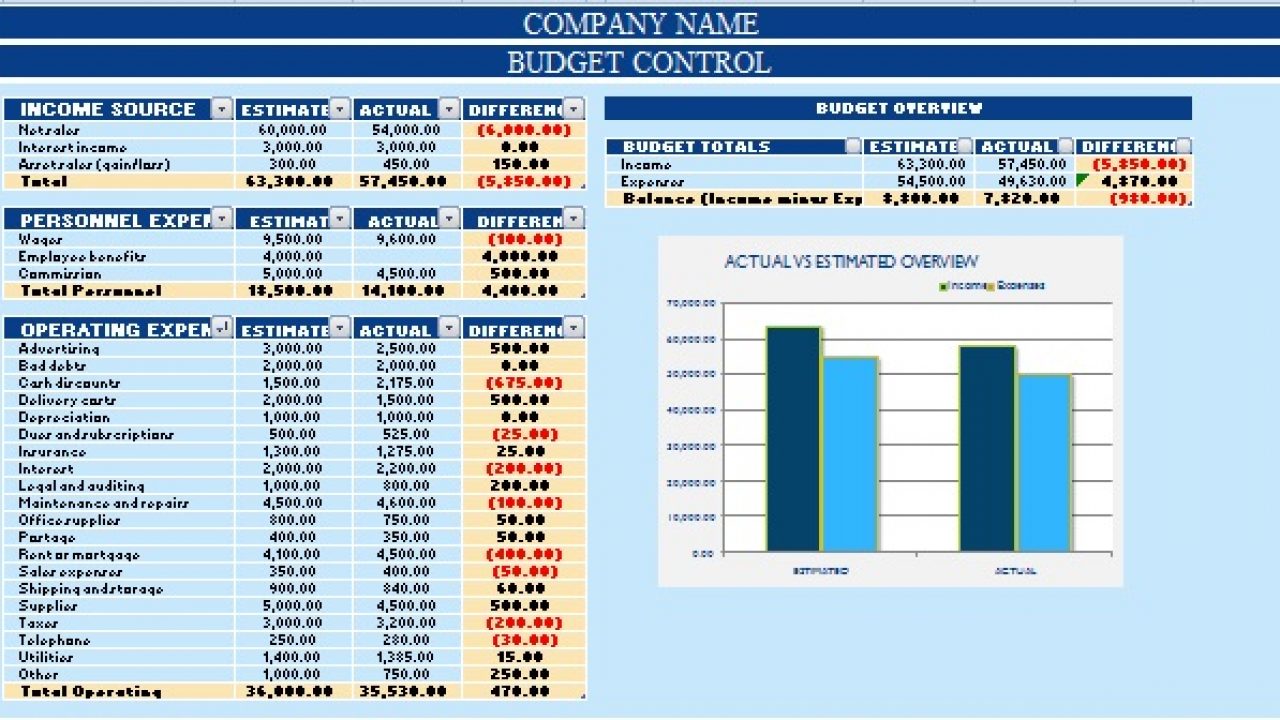

Marketing Communications Budget Template

Who is this budget method for? Web it sounds harder than it is. Needs (50%), wants (30%) and savings (20%). The 50% needs category is for all your monthly essentials. Web to start making your budget, you have to go to the source of it all:

50 30 20 Budget Spreadsheet Template Google Spreadshee 50 30 20 budget

Web what is the 50 30 20 rule? How do you pay off debt with a 50 / 20 / 30 budget? Determine surplus or shortage step 06: Web percentages for your budget. Web with that information, the worksheet shows how your finances compare with the 50/30/20 budget breakdown, which recommends that 50% of your income goes toward needs, 30%.

503020 Budgeting LAOBING KAISUO

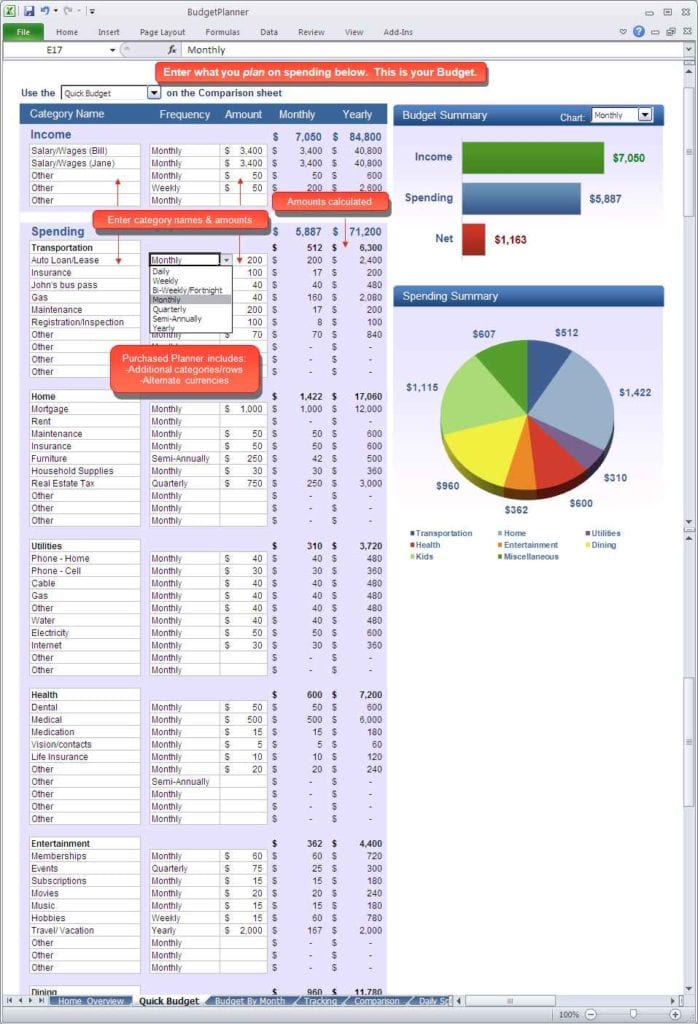

Web to start making your budget, you have to go to the source of it all: Follow along for a quick budget example. Calculate monthly income step 02: If this budget sheet isn’t right for you, try another tool. And then make three columns:

Free 50/30/20 Budget Calculator for Your Foundation Template

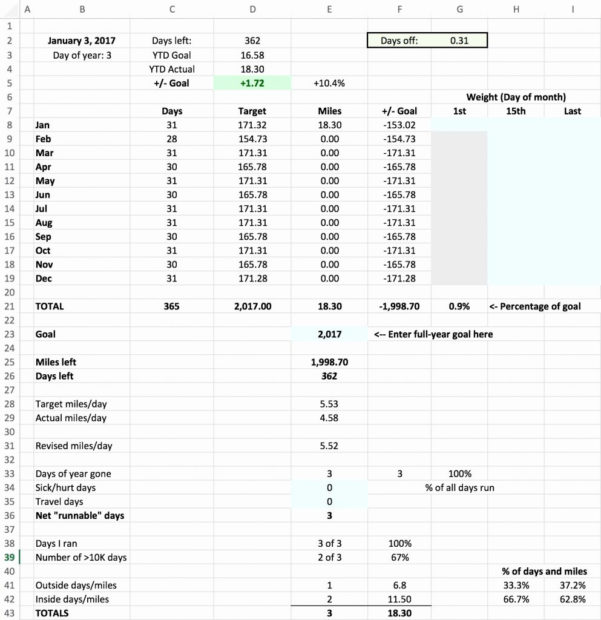

Calculate monthly income step 02: Determine surplus or shortage step 06: How to set up a 50 / 30 / 20 budget. Insert chart to visualize easily free template:. Compare actual expenses with the ideal budget step 05:

50 30 20 Budget Spreadsheet Template throughout 50 30 20 Budget

And then make three columns: What budget apps work with the 50 / 30 /. Web with that information, the worksheet shows how your finances compare with the 50/30/20 budget breakdown, which recommends that 50% of your income goes toward needs, 30% toward wants and 20% toward. Web it sounds harder than it is. Compare actual expenses with the ideal.

Student Budget Planner Spreadsheet —

50% for needs, 30% for wants, and also 20% for savings. And then make three columns: Insert chart to visualize easily free template:. Choose a standard month and start by writing down your net employment income as well as all other recurring income (family allowances, invalidity pension…). Who is this budget method for?

50 30 20 Budget Excel Spreadsheet —

Who is this budget method for? The 50% needs category is for all your monthly essentials. Web percentages for your budget. How do you pay off debt with a 50 / 20 / 30 budget? And then make three columns:

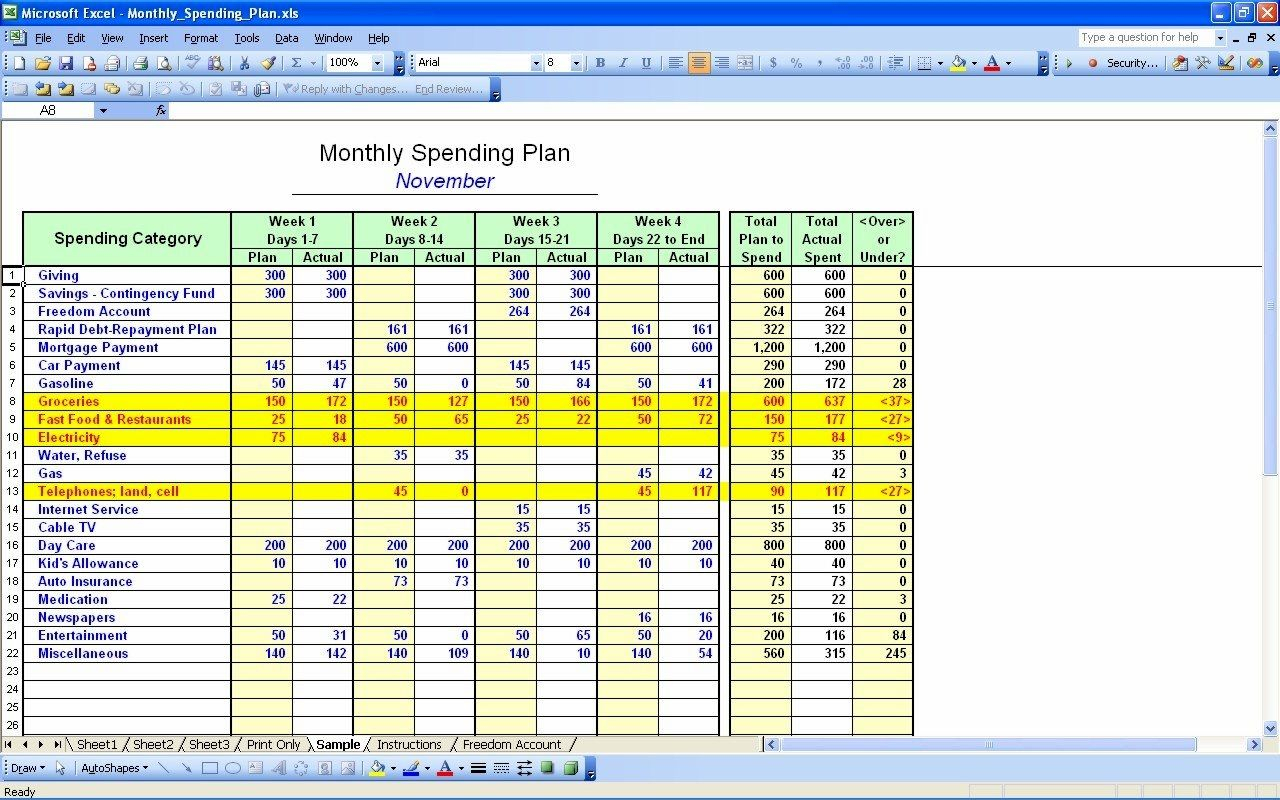

dave ramsey budget spreadsheet excel free —

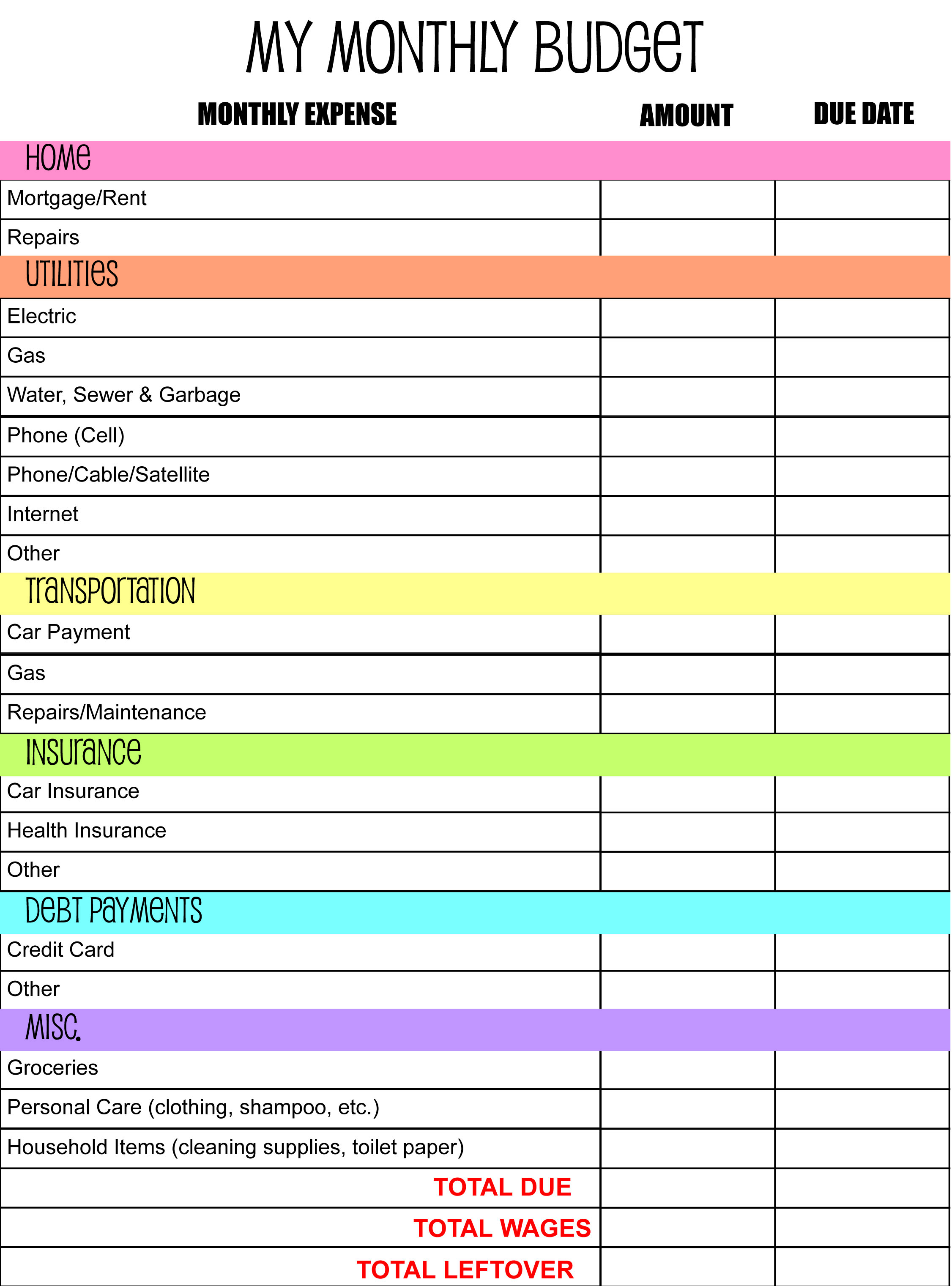

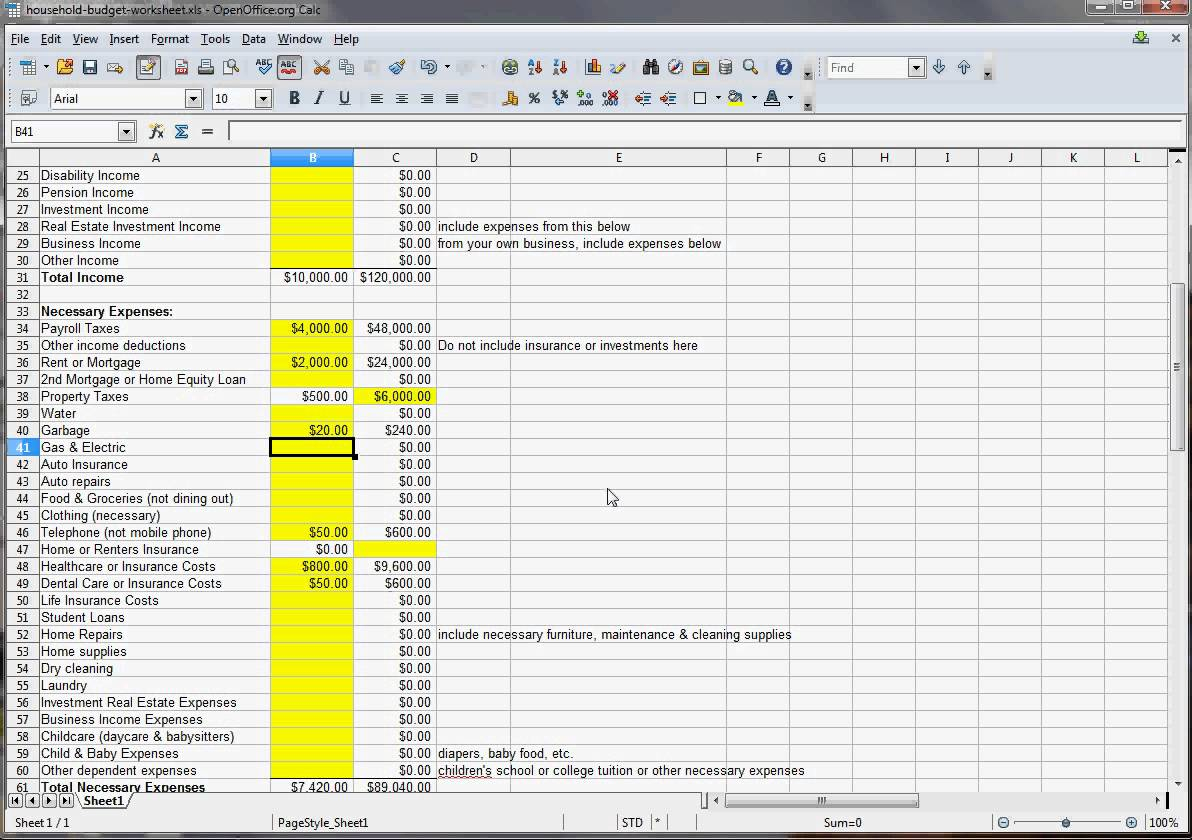

Web use the free budget worksheet below to see how your spending compares with the 50/30/20 budget guide. Choose a standard month and start by writing down your net employment income as well as all other recurring income (family allowances, invalidity pension…). Web what is the 50 30 20 rule? How do you pay off debt with a 50 /.

Budget Vs Actual Excel Template For Your Needs

Web what is the 50 30 20 rule? Needs (50%), wants (30%) and savings (20%). Insert chart to visualize easily free template:. Adjust your actual spending to fit; $720 (401k and hsa) total income:

50 30 20 Budget Excel Spreadsheet with regard to Template Budget

The 50% needs category is for all your monthly essentials. Follow along for a quick budget example. Insert chart to visualize easily free template:. Web to start making your budget, you have to go to the source of it all: Figure out your total monthly income;

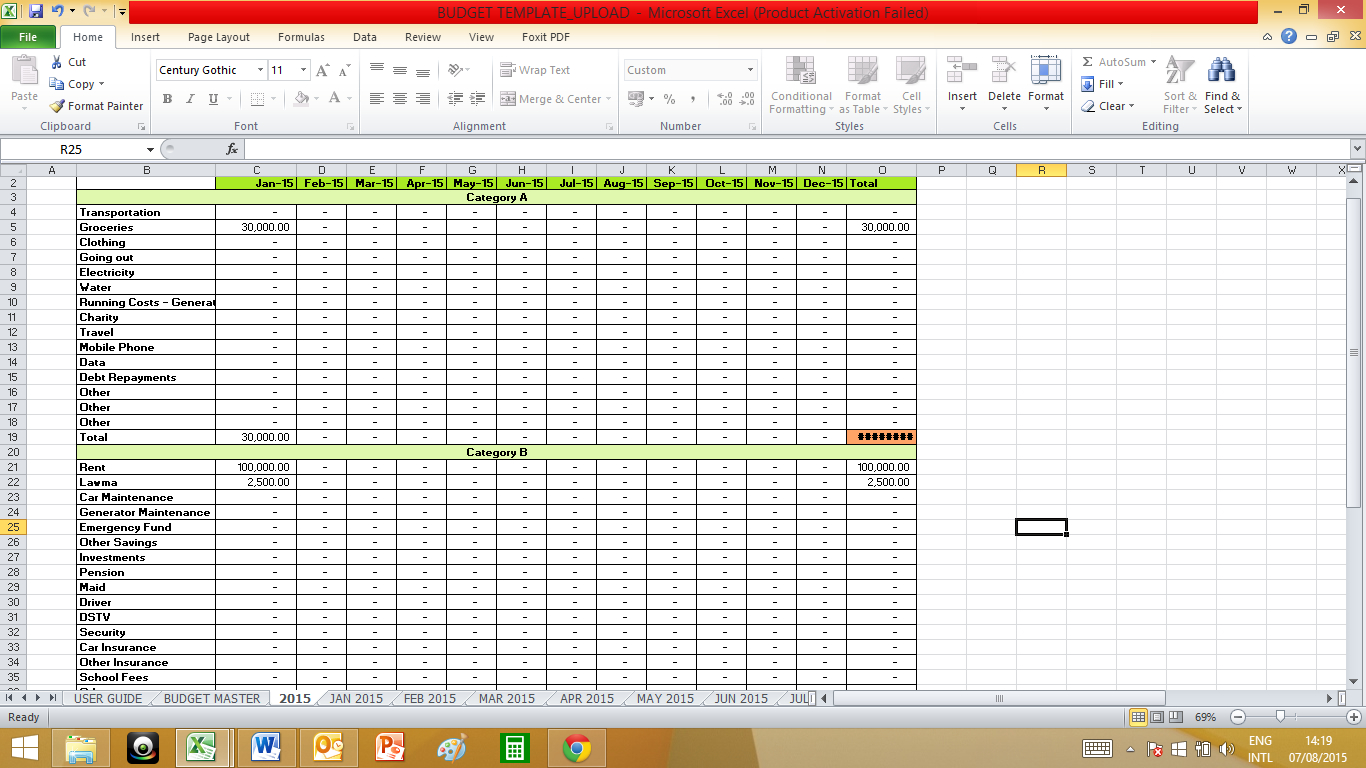

Web 50/30/20 budget excel spreadsheet template. Needs (50%), wants (30%) and savings (20%). Needs 50% or $1990, wants 30% or $1194, savings & debts 20% or $796. Web it sounds harder than it is. 50% of net pay for needs, 30% for wants and 20% for savings and debt repayment. Web use the free budget worksheet below to see how your spending compares with the 50/30/20 budget guide. Web to start making your budget, you have to go to the source of it all: Web what is the 50 30 20 rule? Calculate monthly income step 02: Split your income between the 3 categories; Choose a standard month and start by writing down your net employment income as well as all other recurring income (family allowances, invalidity pension…). How do you pay off debt with a 50 / 20 / 30 budget? Insert chart to visualize easily free template:. Web with that information, the worksheet shows how your finances compare with the 50/30/20 budget breakdown, which recommends that 50% of your income goes toward needs, 30% toward wants and 20% toward. Adjust your actual spending to fit; $720 (401k and hsa) total income: And then make three columns: What budget apps work with the 50 / 30 /. Compare actual expenses with the ideal budget step 05: Follow along for a quick budget example.

Adjust Your Actual Spending To Fit;

What budget apps work with the 50 / 30 /. Follow along for a quick budget example. How do you pay off debt with a 50 / 20 / 30 budget? Web with that information, the worksheet shows how your finances compare with the 50/30/20 budget breakdown, which recommends that 50% of your income goes toward needs, 30% toward wants and 20% toward.

How To Set Up A 50 / 30 / 20 Budget.

Web percentages for your budget. Determine surplus or shortage step 06: Calculate monthly income step 02: Needs (50%), wants (30%) and savings (20%).

Web 50/30/20 Budget Excel Spreadsheet Template.

Insert chart to visualize easily free template:. Figure out your total monthly income; Choose a standard month and start by writing down your net employment income as well as all other recurring income (family allowances, invalidity pension…). 50% of net pay for needs, 30% for wants and 20% for savings and debt repayment.

Compare Actual Expenses With The Ideal Budget Step 05:

Web what is the 50 30 20 rule? And then make three columns: Who is this budget method for? The 50% needs category is for all your monthly essentials.