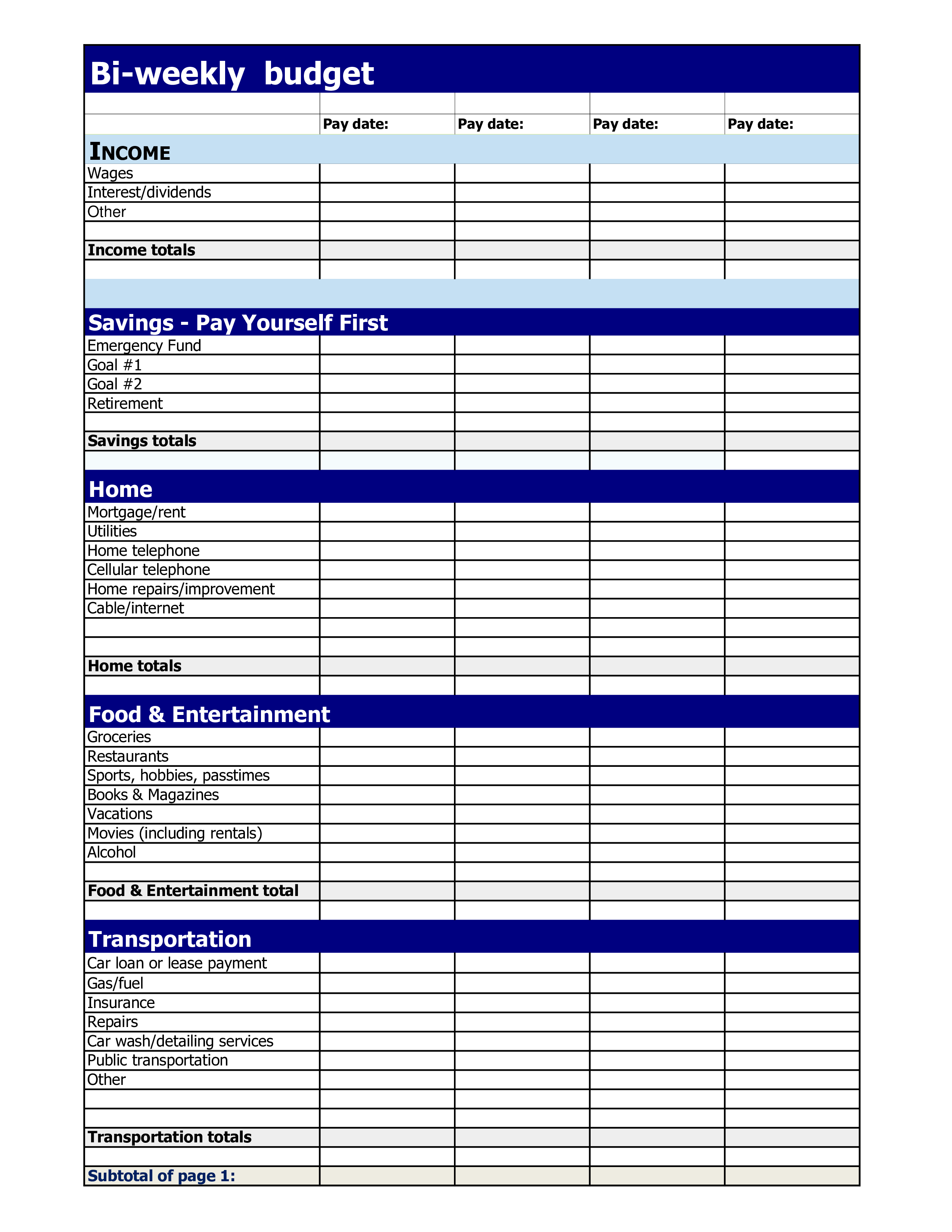

Bi Weekly Budget Template Printable - Web a biweekly budget is an imperative skill to have if your income is inconsistent, or if you are paid biweekly, because it’s the true way to tell your money what to do each pay period and reach your financial goals. It must be customized to suit your biweekly entries and always have enough space for extra entries. It hence covers the expenses that revolve or recur twice a week as opposed to the monthly cycles that are in vogue for a large part. Having a budget system like this helps you save for a rainy day and makes sure you control your spending habits a. For example, if you earn $2000 from work and you also get $1000 from your rental house, you can determine your income as below: That includes your fixed expenses, such as rent or mortgage payments and all of your bills, as well as variable expenses, such as groceries, clothing. Budgets come in varied shapes and sizes. However, this way of doing it has a huge problem for most people: This type of budget is beneficial for those who are paid on a biweekly schedule, as it allows them to plan their spending more effectively. You can print 12 copies and make a diy budget book for an entire year to create a monthly budget planner.

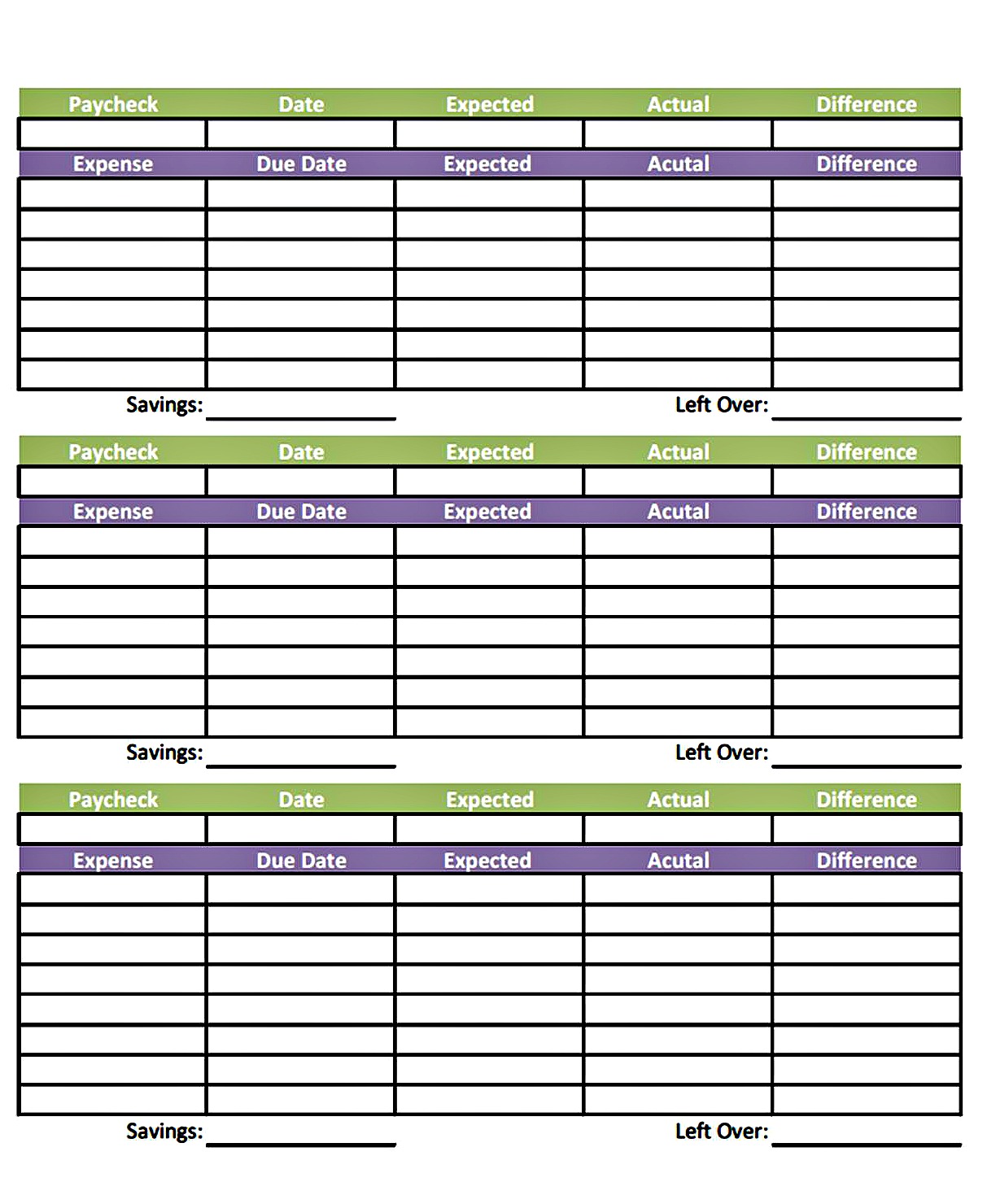

7 Best Images of Printable Paycheck Budget Free Printable Paycheck

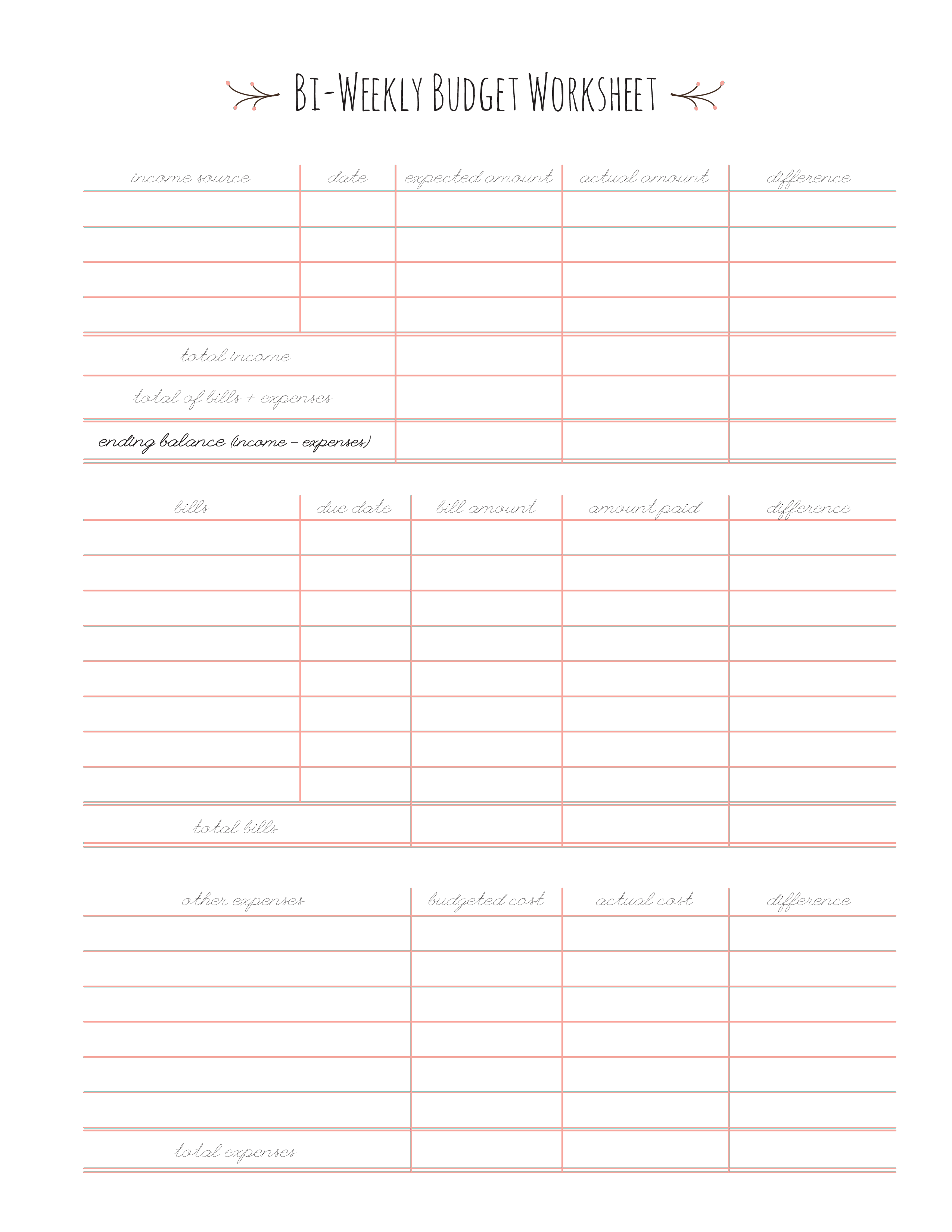

Web here's how to create a biweekly budget in six steps. For example, if you earn $2000 from work and you also get $1000 from your rental house, you can determine your income as below: Web free budget planner worksheet. 3.2 save for a big goal; 3.1 make an emergency fund;

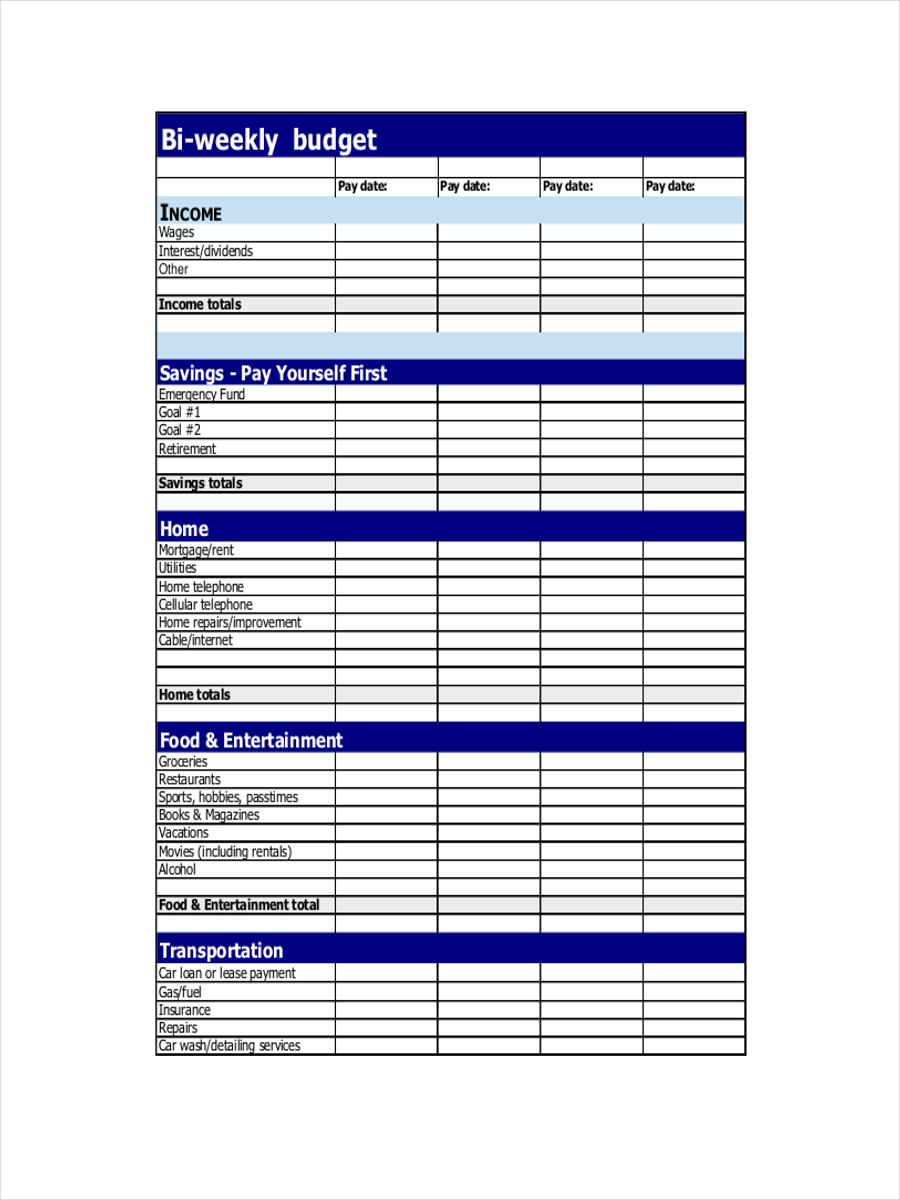

BiWeekly Budget Examples 9+ Samples in Google Docs Google Sheets

It must be customized to suit your biweekly entries and always have enough space for extra entries. We offer a simple monthly budget template in different formats, including excel, google sheets, word, google docs, pdf, or as an image. Here are the free weekly budget templates that you download. Start creating your biweekly budget planner by printing out a calendar.

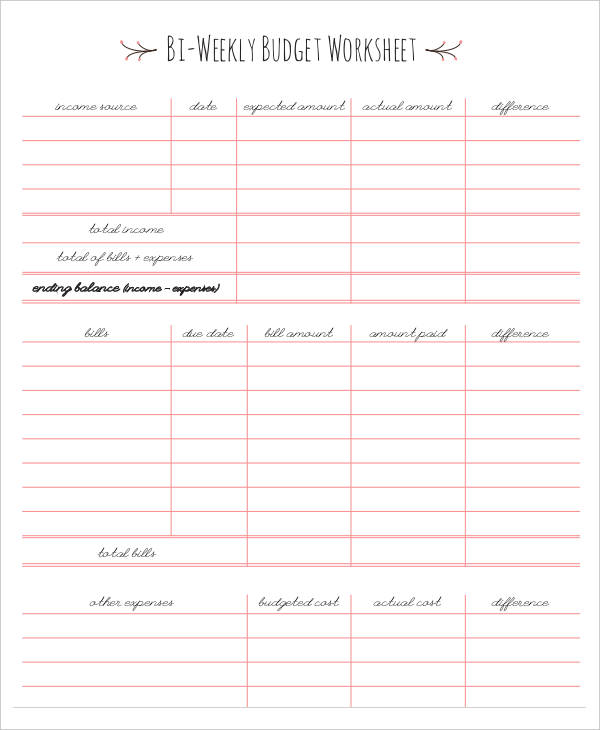

Bi Weekly Expenses Spreadsheet —

Web free download this bi weekly paycheck budget template design in word, google docs format. Start creating your biweekly budget planner by printing out a calendar to track your budget. For example, if you earn $2000 from work and you also get $1000 from your rental house, you can determine your income as below: However, this way of doing it.

Biweekly Budget Template 8+ Free Word, PDF Documents Download Free

Web a biweekly budget is an imperative skill to have if your income is inconsistent, or if you are paid biweekly, because it’s the true way to tell your money what to do each pay period and reach your financial goals. Here are the free weekly budget templates that you download. However, this way of doing it has a huge.

26+ Free BiWeekly Budget Templates MS Office Documents

Web free download this bi weekly paycheck budget template design in word, google docs format. 2.2 get ahead on bills; As its designation implies, this is a budget that is crafted twice a week. Web free budget planner worksheet. Much like with a monthly budget, your first step in creating a budget is to take inventory of all your expenses.

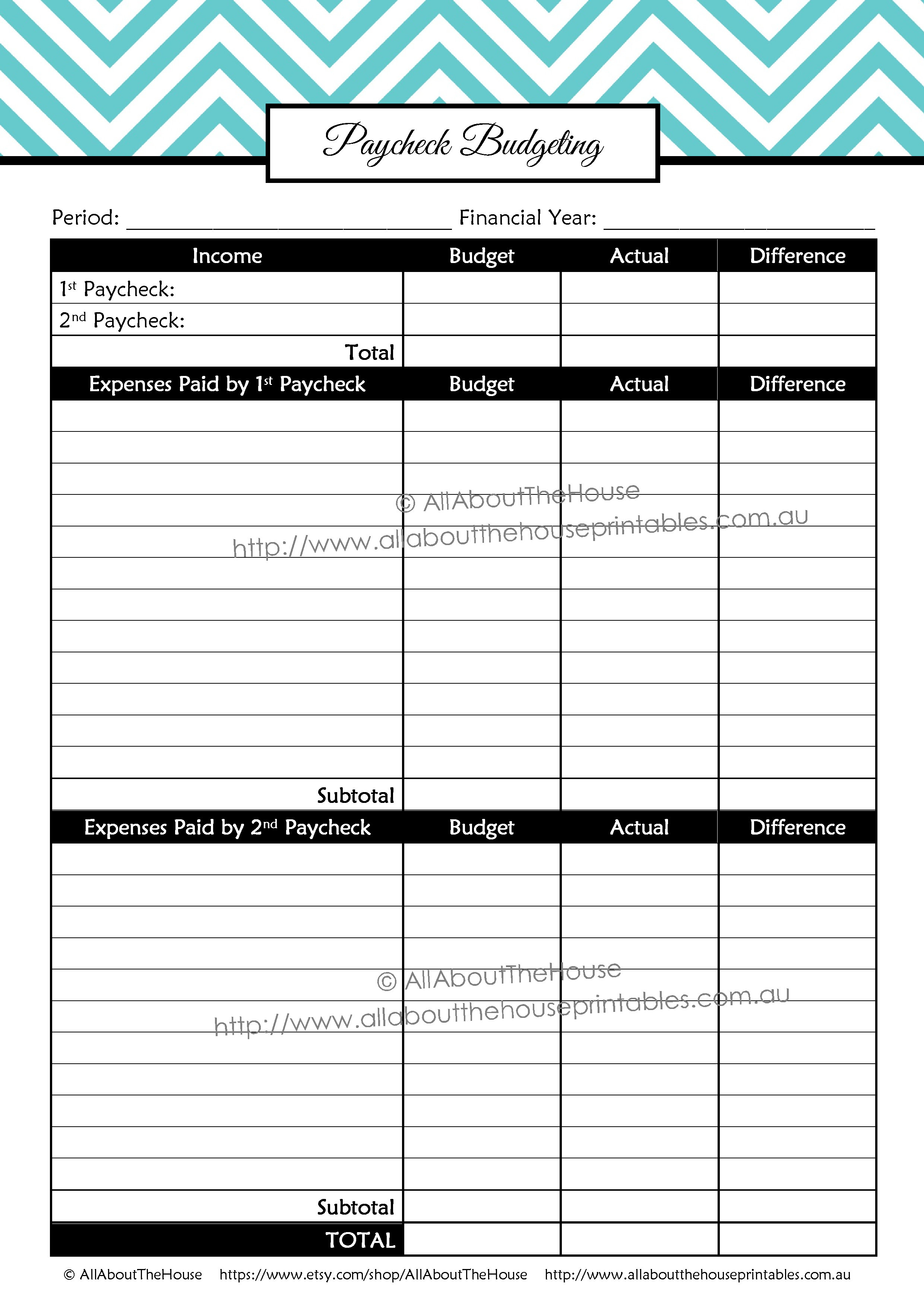

Bi Weekly Budget Template 2021 Etsy

Much like with a monthly budget, your first step in creating a budget is to take inventory of all your expenses. 3.2 save for a big goal; Having a budget system like this helps you save for a rainy day and makes sure you control your spending habits a. Again, this is the most important bit. Web a biweekly budget.

Printable Bi Weekly Budget Templates at

It must be customized to suit your biweekly entries and always have enough space for extra entries. Web here's how to create a biweekly budget in six steps. That includes your fixed expenses, such as rent or mortgage payments and all of your bills, as well as variable expenses, such as groceries, clothing. Budgets come in varied shapes and sizes..

Bi Weekly Budget Worksheet Templates at

Web free budget planner worksheet. Secondly, you can track weekly savings according to the information of your expenses and income. It assumes that all expenses and all income are made at the same time. Web a biweekly budget is an imperative skill to have if your income is inconsistent, or if you are paid biweekly, because it’s the true way.

Download BiWeekly Budget Template for Free Page 2 FormTemplate

This type of budget is beneficial for those who are paid on a biweekly schedule, as it allows them to plan their spending more effectively. You can use them to create your own. It hence covers the expenses that revolve or recur twice a week as opposed to the monthly cycles that are in vogue for a large part. As.

Biweekly Budget Template 2 PRINTABLE Finance Budget Sheets Etsy

Having a budget system like this helps you save for a rainy day and makes sure you control your spending habits a. 3.2 save for a big goal; Here are the free weekly budget templates that you download. Web free download this bi weekly paycheck budget template design in word, google docs format. Web now that we have the basics.

Like my original money management template, you can customize budget categories and track multiple accounts, but this version includes everything in a single worksheet and uses fewer budget categories. It hence covers the expenses that revolve or recur twice a week as opposed to the monthly cycles that are in vogue for a large part. This template works for a weekly, biweekly, or monthly budget. It must be customized to suit your biweekly entries and always have enough space for extra entries. 2.2 get ahead on bills; Add your income and expenses to this monthly budget template, and we'll show how your spending aligns with the 50/30/20 rule. Web a biweekly budget is an imperative skill to have if your income is inconsistent, or if you are paid biweekly, because it’s the true way to tell your money what to do each pay period and reach your financial goals. 3.2 save for a big goal; That includes your fixed expenses, such as rent or mortgage payments and all of your bills, as well as variable expenses, such as groceries, clothing. Web a biweekly budget is a budget that takes into account a person collecting a paycheck every 14 days. Here are the free weekly budget templates that you download. However, many people find it difficult when bills are due on a monthly basis. You can use them to create your own. 3.1 make an emergency fund; As its designation implies, this is a budget that is crafted twice a week. This type of budget is beneficial for those who are paid on a biweekly schedule, as it allows them to plan their spending more effectively. Secondly, you can track weekly savings according to the information of your expenses and income. Again, this is the most important bit. It assumes that all expenses and all income are made at the same time. However, this way of doing it has a huge problem for most people:

Web Here's How To Create A Biweekly Budget In Six Steps.

2.2 get ahead on bills; This template works for a weekly, biweekly, or monthly budget. Secondly, you can track weekly savings according to the information of your expenses and income. However, many people find it difficult when bills are due on a monthly basis.

Web Free Budget Planner Worksheet.

It assumes that all expenses and all income are made at the same time. Web a biweekly budget is an imperative skill to have if your income is inconsistent, or if you are paid biweekly, because it’s the true way to tell your money what to do each pay period and reach your financial goals. Budgets come in varied shapes and sizes. 3.3 fund much needed rewards;

It Must Be Customized To Suit Your Biweekly Entries And Always Have Enough Space For Extra Entries.

Download the free easy budget biweekly budget template here 3.1 make an emergency fund; Start creating your biweekly budget planner by printing out a calendar to track your budget. As its designation implies, this is a budget that is crafted twice a week.

Add Your Income And Expenses To This Monthly Budget Template, And We'll Show How Your Spending Aligns With The 50/30/20 Rule.

Web now that we have the basics down, let’s look at the steps involved in creating a biweekly budget. It hence covers the expenses that revolve or recur twice a week as opposed to the monthly cycles that are in vogue for a large part. That includes your fixed expenses, such as rent or mortgage payments and all of your bills, as well as variable expenses, such as groceries, clothing. Having a budget system like this helps you save for a rainy day and makes sure you control your spending habits a.