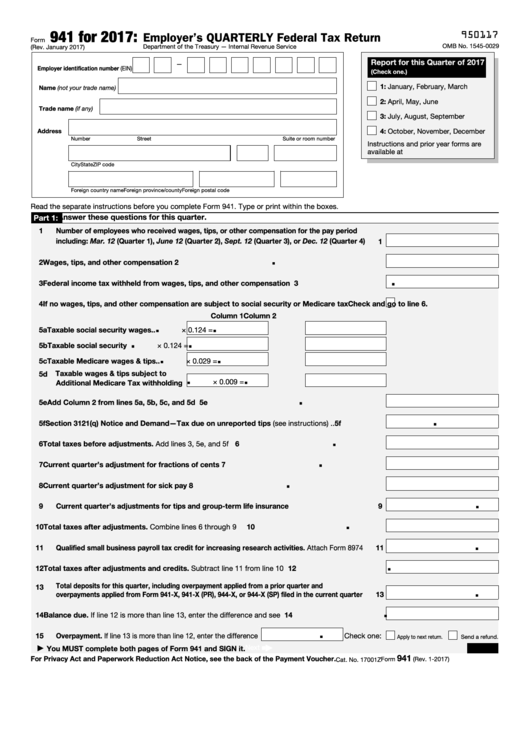

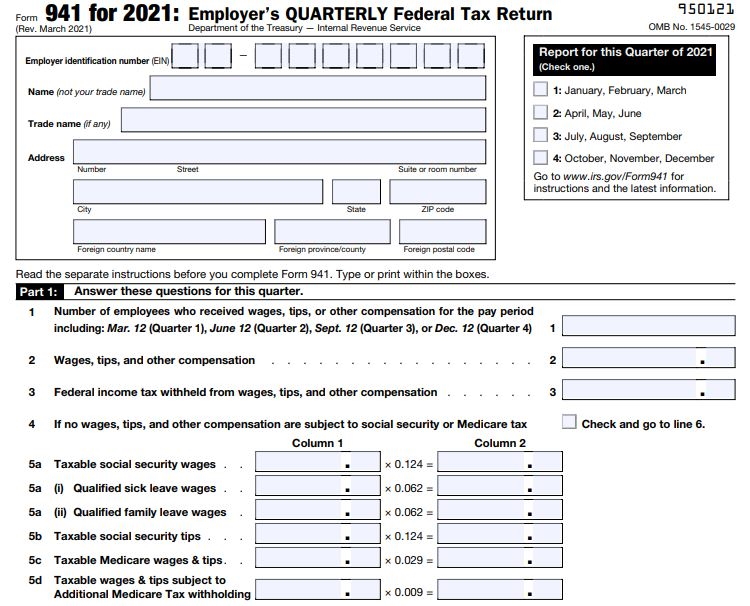

Form 941 Excel Template - Type or print within the boxes. October, november, december go to www.irs.gov/form941 for instructions and the latest information. Use forms for the calendar year being balanced only. Web home forms and instructions about form 941, employer's quarterly federal tax return employers use form 941 to: If you are an employer who files the quarterly employment tax form to the irs, you should be aware of worksheet 1. Web to do this, highlight column a and then in your excel toolbar click format, then cells, text and then ok. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. The irs has made changes to form 941 for the 2nd quarter of 2022. Fill & download for free get form download the form a comprehensive guide to editing the form 941 worksheet 1 excel below you can get an idea about how to edit and complete a form 941 worksheet 1 excel hasslefree. Learn more form 941 worksheet for 2022

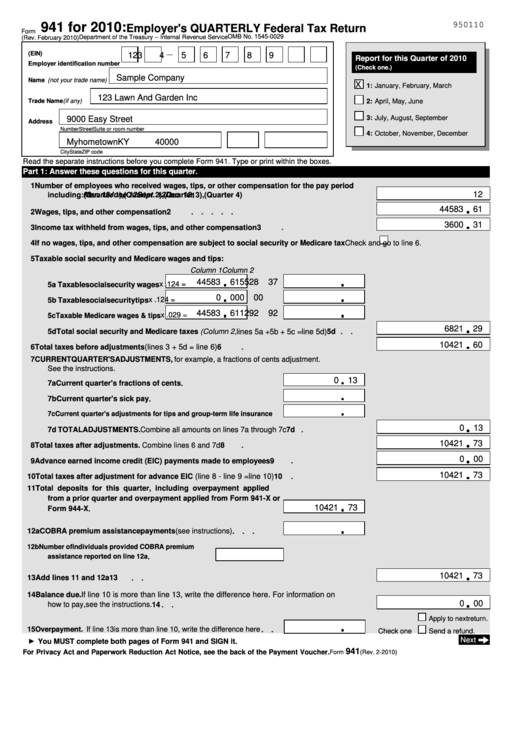

How to Fill Out 2020 Form 941 Employer’s Quarterly Federal Tax Return

Web form 941 worksheet 1. 001223333) will drop the leading zeroes. Thus, any employer who files the quarterly employment tax form to the irs under cares act and employees retention credit should use this worksheet. You should potentially use worksheet 1 when claiming credits under the cares act and employee retention credit for the second quarter of 2020 and beyond..

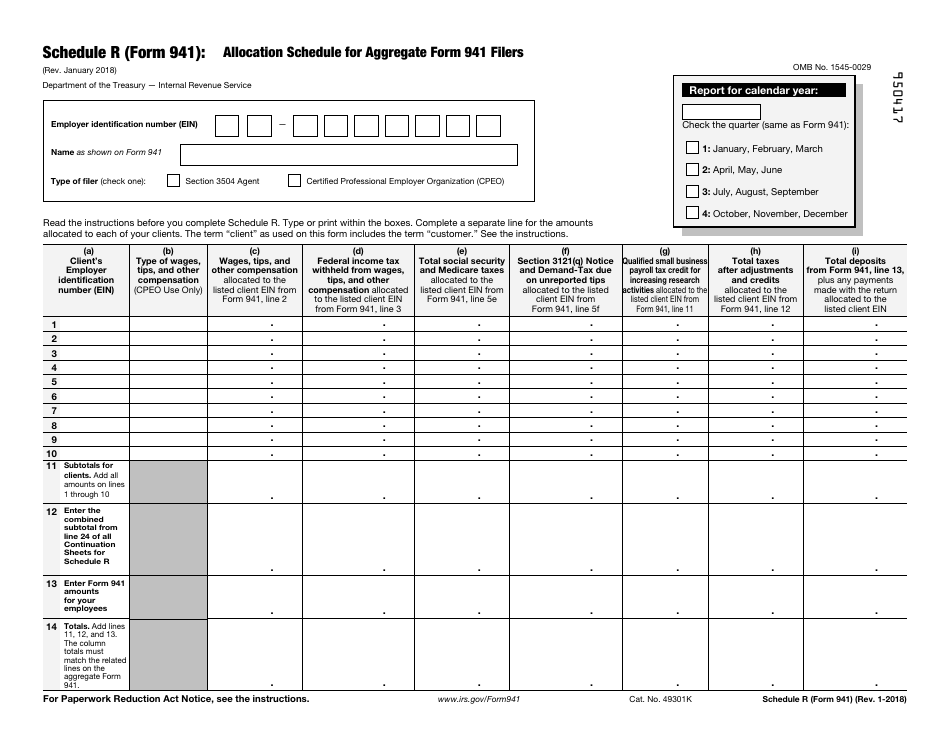

IRS Form 941 Schedule R Download Fillable PDF or Fill Online Allocation

Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. You should potentially use worksheet 1 when claiming credits under the cares act and employee retention credit for the second quarter of 2020 and beyond. Use forms for the calendar year being balanced only. Web to do this, highlight column a and then in your excel toolbar.

How to fill out IRS Form 941 2019 PDF Expert

Web home forms and instructions about form 941, employer's quarterly federal tax return employers use form 941 to: You can follow the question or vote as. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Fill in the empty fields; Push the“get form” button below.

Download 2013 Form 941 for Free Page 2 FormTemplate

Thus, any employer who files the quarterly employment tax form to the irs under cares act and employees retention credit should use this worksheet. Employers need to complete the worksheets that correspond to the credits they claimed during the quarter. October, november, december go to www.irs.gov/form941 for instructions and the latest information. Web form 941 worksheet 1 is designed to.

Fillable Form 941 Employer'S Quarterly Federal Tax Return, Form 941V

Web 941 irs excel template. Read the separate instructions before you complete form 941. Worksheet 1 will help in determining the. Numbers can be entered with or without hyphens (e.g. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks.

Download IRS Form 941 Worksheet Template for FREE

Web the irs has released an updated version of form 941 for the 2nd through 4th quarters of 2020, the 1st quarter 2021, the 2nd through 4th quarters of 2021, and the 1st quarter of 2022 and later. You can follow the question or vote as. Prior revisions of form 941 are available at irs.gov/form941 (select the link for Engaged.

Irs form 941 Fillable How to Fill Out Tax form 941 Intro Video in 2020

Web instructions for form 941. It is important this is completed in advance, otherwise any entries made which start with zero (e.g. Web the irs has released an updated version of form 941 for the 2nd through 4th quarters of 2020, the 1st quarter 2021, the 2nd through 4th quarters of 2021, and the 1st quarter of 2022 and later..

Form 941 Employers Quarterly Federal Tax Return, Schedule B (Form 941

Fill in the empty fields; Learn more form 941 worksheet for 2022 What's new social security and medicare tax for 2023. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Numbers can be entered with or without hyphens (e.g.

941 Worksheet 1 2020 Fillable Pdf

Provide a copy of the amended form 941 payroll report used for erc to your tax preparer so they can adjust the deductible wages for the period on 2020 tax return. Pay the employer's portion of social security or medicare tax. If these forms are not in balance, penalties from the irs and/or ssa could result. Current revision form 941.

How to Fill out IRS Form 941 Nina's Soap

Pay the employer's portion of social security or medicare tax. Web form 941 worksheet 1 excel: Annual amounts from payroll records should match the total amounts reported on all forms 941 for the year. Numbers can be entered with or without hyphens (e.g. If these forms are not in balance, penalties from the irs and/or ssa could result.

If these forms are not in balance, penalties from the irs and/or ssa could result. Web form 941 worksheet 1. Web time, the irs expects the march 2023 revision of form 941 and these instructions to also be used for the second, third, and fourth quarters of 2023. Edit your form 941 excel template online type text, add images, blackout confidential details, add comments, highlights and more. Below is a summary of the new fields on the form and how accounting cs populates those fields. Provide a copy of the amended form 941 payroll report used for erc to your tax preparer so they can adjust the deductible wages for the period on 2020 tax return. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. We will use the completed voucher to credit your payment more promptly and accurately, and to improve our service to you. What's new social security and medicare tax for 2023. Web form 941 worksheet 1 excel: If you are an employer who files the quarterly employment tax form to the irs, you should be aware of worksheet 1. Worksheet 1 will help in determining the. Current revision form 941 pdf instructions for form 941 ( print version. Web form 941 for 2023: If changes in law require additional changes to form 941, the form and/or these instructions may be revised. Web to do this, highlight column a and then in your excel toolbar click format, then cells, text and then ok. Web 941 irs excel template. You should potentially use worksheet 1 when claiming credits under the cares act and employee retention credit for the second quarter of 2020 and beyond. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Web the irs has released an updated version of form 941 for the 2nd through 4th quarters of 2020, the 1st quarter 2021, the 2nd through 4th quarters of 2021, and the 1st quarter of 2022 and later.

001223333) Will Drop The Leading Zeroes.

Prior revisions of form 941 are available at irs.gov/form941 (select the link for Web form 941 for 2023: If changes in law require additional changes to form 941, the form and/or these instructions may be revised. Worksheet 1 will help in determining the.

Current Revision Form 941 Pdf Instructions For Form 941 ( Print Version.

If you are an employer who files the quarterly employment tax form to the irs, you should be aware of worksheet 1. Engaged parties names, places of residence and phone numbers etc. Learn more form 941 worksheet for 2022 The irs has made changes to form 941 for the 2nd quarter of 2022.

Web Form 941 Worksheet 1.

You can follow the question or vote as. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Web form 941 worksheet 1 excel: We will use the completed voucher to credit your payment more promptly and accurately, and to improve our service to you.

Employer Identification Number (Ein) — Name (Not.

Cwa clients, please note we must have this by june 30th. The formula will calculate the erc automatically and is equal to 50% of eligible wages determined in step 2. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Web to do this, highlight column a and then in your excel toolbar click format, then cells, text and then ok.