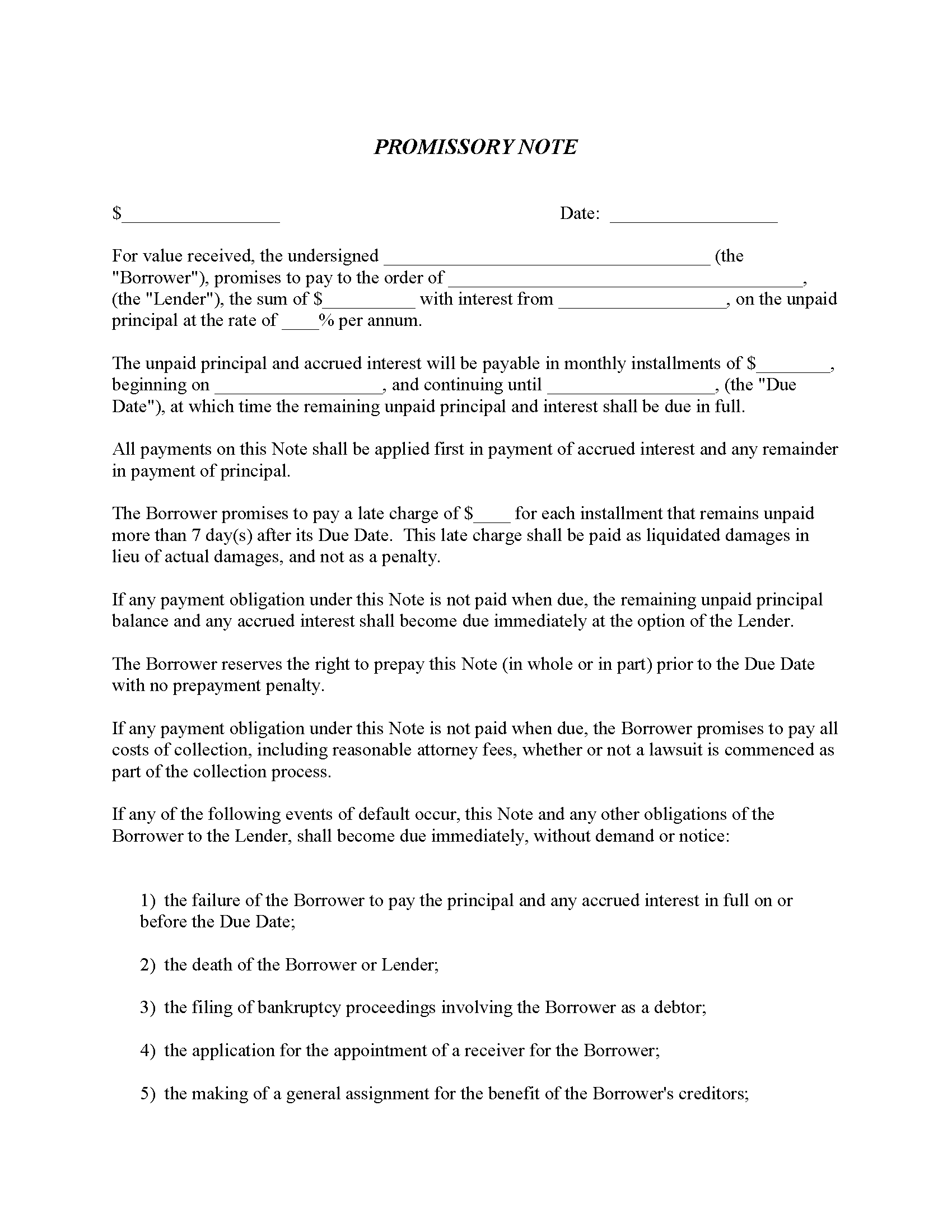

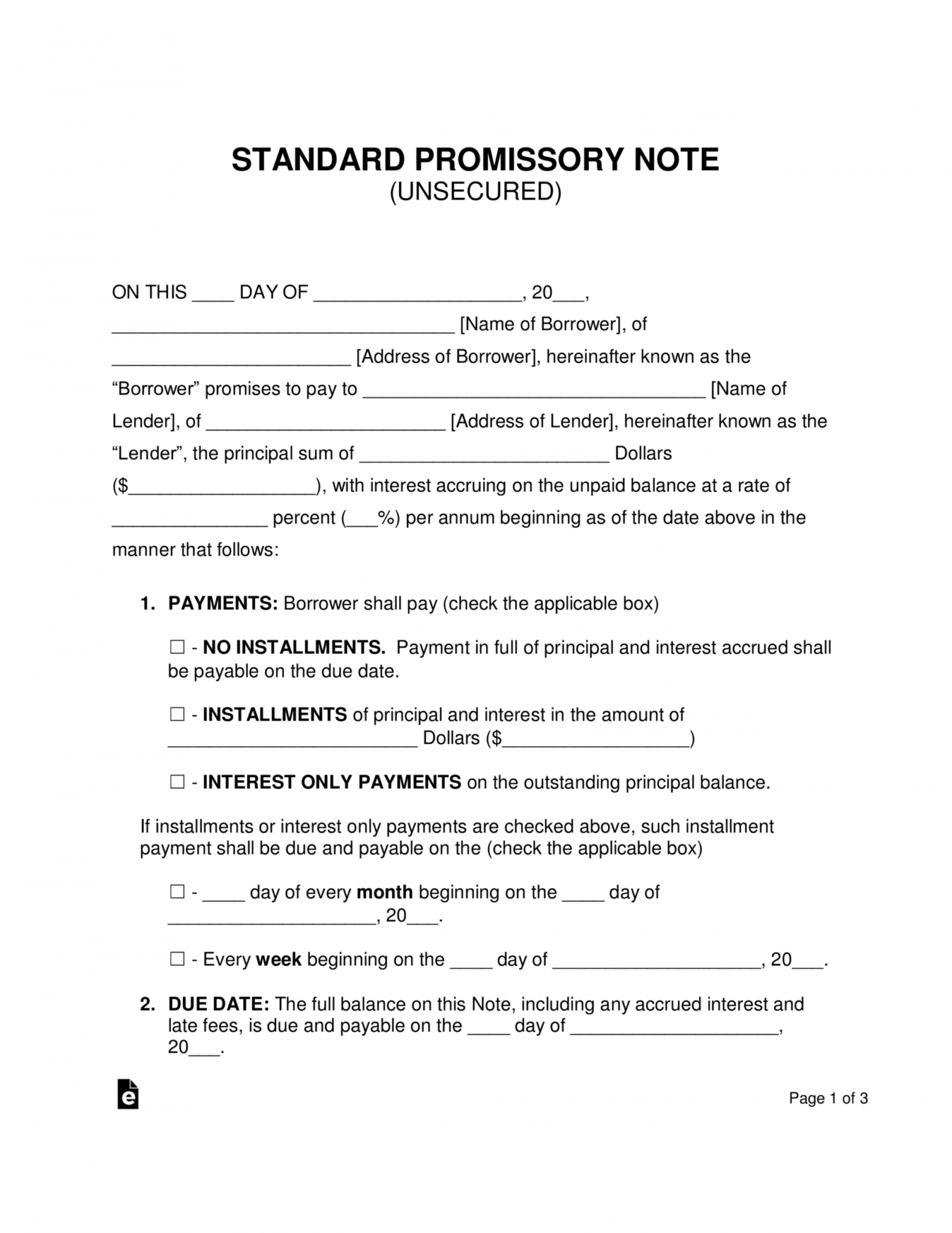

Free Printable Promissory Note - The terms of this note shall control over any conflicting terms in any referenced agreement or document. The note should include the amount of money (the principal amount given to the person promising to pay it back), the interest rate, and the specific terms of repayment. This note may not be modified or amended except by a written agreement signed by borrower and lender. At the top of the form, you are required to provide your and the borrower’s personal information, including the full names and contact addresses. Download your document instantly to your computer and then print or share it with the lender or borrower. The security may not be sold or transferred without the lender’s consent until the due date. Promissory notes have much in common with loan agreements, but the former only binds the borrower and is more informal.they function similarly to iou notes, detailing information about what one person owes another. It is a legal document for a loan and becomes legally binding when signed by the borrower. Web a promissory note is a document that sets out all the details of a loan that has been made between two parties. Web use our promissory note template to detail the terms of loan repayment.

Promissory Note Form Free Printable Legal Forms

Lender borrower create my document your promissory note promissory note (this note) principal amount:. When everything is prepared properly, an unsecured promissory note can make the loan filing process quick and efficient. Even if you think that you will not need strict rules, you will still need to make an agreement between you and the buyer. Web a promissory note.

45 FREE Promissory Note Templates & Forms [Word & PDF] Template Lab

Lender borrower create my document your promissory note promissory note (this note) principal amount:. Preview our promissory note templates to see how your document will look and make any edits. The two parties need to abide by the details of the loan itself while the loan exists, and the promissory note guides this process. Web terms of this note. When.

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

Preview our promissory note templates to see how your document will look and make any edits. It is a legal document for a loan and becomes legally binding when signed by the borrower. This note may not be modified or amended except by written agreement signed by borrower and lender. Web a promissory note is a written promise made by.

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

Web a promissory note is a note payable form whereby a borrower promises to repay the lender. The security may not be sold or transferred without the lender’s consent until the due date. The two parties need to abide by the details of the loan itself while the loan exists, and the promissory note guides this process. Web a promissory.

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

It is a legal document for a loan and becomes legally binding when signed by the borrower. Web promissory note let's figure out which promissory note you need. Answer a few simple questions to create your document. Web the terms of this note. The terms of this note shall control over any conflicting terms in any referenced agreement or document.

45 FREE Promissory Note Templates & Forms [Word & PDF] Template Lab

Web the terms of this note. Web promissory note let's figure out which promissory note you need. Lender borrower create my document your promissory note promissory note (this note) principal amount:. It is a legal document for a loan and becomes legally binding when signed by the borrower. The terms of this note shall control over any conflicting terms in.

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

Web a promissory note is a note payable form whereby a borrower promises to repay the lender. When everything is prepared properly, an unsecured promissory note can make the loan filing process quick and efficient. The security may not be sold or transferred without the lender’s consent until the due date. Any notices required or permitted to be given hereunder.

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

Web a promissory note is a document that sets out all the details of a loan that has been made between two parties. Download your document instantly to your computer and then print or share it with the lender or borrower. It is a legal document for a loan and becomes legally binding when signed by the borrower. The note.

Printable Free Unsecured Promissory Note Template Word Pdf Unsecured

Updated july 3, 2023 | legally reviewed by susan chai, esq. Web a promissory note, also known as an iou, is a legal document that memorializes the terms of a loan, including interest and the repayment schedule. Promissory notes have much in common with loan agreements, but the former only binds the borrower and is more informal.they function similarly to.

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

Any notices required or permitted to be given hereunder shall be given in Web a secured promissory note is an acknowledgment of debt that includes collateral (security) if the borrower defaults. Updated july 3, 2023 | legally reviewed by susan chai, esq. Web the terms of this note. Web a promissory note is a written promise made by a borrower.

Web a promissory note, also known as an iou, is a legal document that memorializes the terms of a loan, including interest and the repayment schedule. Web a promissory note is a document that sets out all the details of a loan that has been made between two parties. This note may not be modified or amended except by a written agreement signed by borrower and lender. It is beneficial to create a promissory note because it secures the integrity of the loan. The terms of this note shall control over any conflicting terms in any referenced agreement or document. Web a promissory note is a written promise made by a borrower to a lender to repay a specified sum of money. Promissory notes protect the contractual relationship between the lender and the borrower and are essential debt instruments in businesses and personal finance. Updated july 3, 2023 | legally reviewed by susan chai, esq. A promissory note must be signed by the borrower, it must outline the sum of the debt, and it can specify more detailed loan terms if both parties agree. The two parties need to abide by the details of the loan itself while the loan exists, and the promissory note guides this process. It is a legal document for a loan and becomes legally binding when signed by the borrower. Web a promissory note is a legal contract between a lender and a borrower that defines the terms of a loan, including payment details, interest, late fees, any collateral, and more. Web download sample professional promissory note example here is a sample promissory note that sets out the amount and terms of the loan: This agreement also outlines what will happen if the debt is not repaid. At the top of the form, you are required to provide your and the borrower’s personal information, including the full names and contact addresses. Web terms of this note. Answer a few simple questions to create your document. Web immediately pursuant to section 6a of this note. Web use our promissory note template to detail the terms of loan repayment. Lender borrower create my document your promissory note promissory note (this note) principal amount:.

Web It’s Important To Be Sure Before Signing An Unsecured Promissory Note That The Lender Is Willing To Take The Risk And That The Borrower Is Capable Of Paying Back The Loan.

Web a promissory note is a written promise made by a borrower to a lender to repay a specified sum of money. The two parties need to abide by the details of the loan itself while the loan exists, and the promissory note guides this process. Web a promissory note is a note payable form whereby a borrower promises to repay the lender. If you have ever accessed a loan, you have signed a promissory note at one point.

The Note Will Include When The Payments Are Due And, If Paid Late, The Security Will Be Handed Over To The Lender As A.

The note should include the amount of money (the principal amount given to the person promising to pay it back), the interest rate, and the specific terms of repayment. At the top of the form, you are required to provide your and the borrower’s personal information, including the full names and contact addresses. Updated july 3, 2023 | legally reviewed by susan chai, esq. This agreement also outlines what will happen if the debt is not repaid.

The Security May Not Be Sold Or Transferred Without The Lender’s Consent Until The Due Date.

Web a promissory note, also known as an iou, is a legal document that memorializes the terms of a loan, including interest and the repayment schedule. Preview our promissory note templates to see how your document will look and make any edits. It is beneficial to create a promissory note because it secures the integrity of the loan. Web use our promissory note template to detail the terms of loan repayment.

Will The Loan Be Guaranteed By Some Kind Of Collateral Or Other Security?

Promissory notes protect the contractual relationship between the lender and the borrower and are essential debt instruments in businesses and personal finance. Web download free printable promissory note templates that may be written in fillable adobe pdf (.pdf), ms word (.doc), and rich text format (.rtf). If borrower breaches this provision, lender may declare all sums due under this note immediately due and payable, unless prohibited by applicable law. It is a legal document for a loan and becomes legally binding when signed by the borrower.

![45 FREE Promissory Note Templates & Forms [Word & PDF] Template Lab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-32.jpg)

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-01.jpg)

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-02.jpg)

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-38.jpg)

![45 FREE Promissory Note Templates & Forms [Word & PDF] Template Lab](http://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-10.jpg)

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-22.jpg)

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-19.jpg)

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-17.jpg)