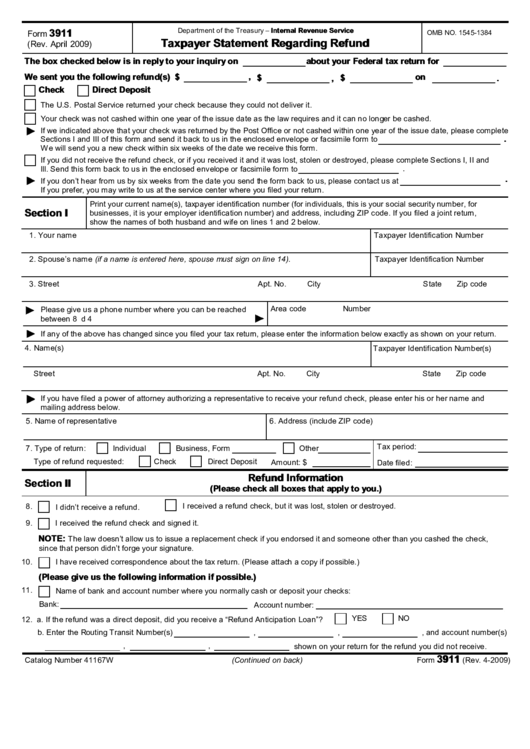

Irs Form 3911 Printable - Web irs form 3911, taxpayer statement regarding refund, is the tax form that a taxpayer may use to inform the irs of a missing tax refund. Form 3911 is used by a taxpayer who was issued a refund either by direct deposit or. If your filing status is married filing jointly. By filing this form, the taxpayer initiates a refund trace. The information below is in reply to your inquiry on. Web what is a form 3911, taxpayer statement regarding refund? The form must be completed and mailed or faxed to the specified irs office. What is the irs refund trace process like? You need to complete form 3911, taxpayer statement regarding refund, and mail it to the irs address where you would normally file a paper tax return. Married filing joint taxpayers must complete and jointly sign the form 3911 and return it to the irs before a refund trace can be initiated by the refund inquiry examiner.

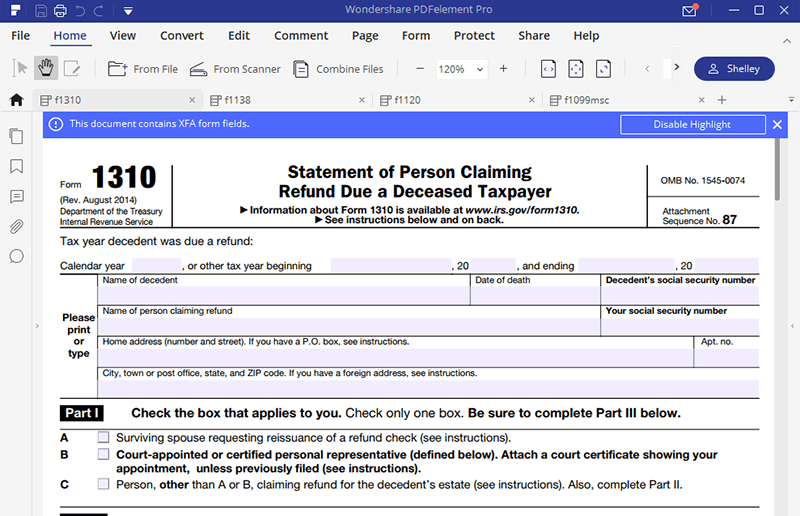

How To Sign 1040 With Power Of Attorney

The information below is in reply to your inquiry on. Form 3911 is used by a taxpayer who was issued a refund either by direct deposit or. Web information about form 3911, taxpayer statement regarding refund, including recent updates, related forms, and instructions on how to file. Web print your current name(s), taxpayer identification number (for individuals, this is your.

Form 3911 Taxpayer Statement Regarding Refund (Fillible) printable

Form 3911 is used by a taxpayer who was issued a refund either by direct deposit or. Web go to “where’s my refund?” at irs.gov or use the irs2go mobile app and follow the prompts to begin a refund trace. If your filing status is married filing jointly. By filing this form, the taxpayer initiates a refund trace. Form 3911.

20182022 Form IRS 3911 Fill Online, Printable, Fillable, Blank pdfFiller

If your filing status is married filing jointly. About your federal tax refund forif you did not receive your refund or if the refund check you received was lost, stolen or destroyed, complete the. Web irs form 3911, taxpayer statement regarding refund, is the tax form that a taxpayer may use to inform the irs of a missing tax refund..

Form 3911 Taxpayer Statement Regarding Refund (2012) Free Download

Form 3911 is also known as a taxpayer statement regarding refund. Web regardless of the reason for never receiving your tax refund, filing form 3911 with the irs helps trace your refund to determine its whereabouts. About your federal tax refund forif you did not receive your refund or if the refund check you received was lost, stolen or destroyed,.

Form 3911 Printable

The information below is in reply to your inquiry on. Web go to “where’s my refund?” at irs.gov or use the irs2go mobile app and follow the prompts to begin a refund trace. The form must be completed and mailed or faxed to the specified irs office. Form 3911 is provided to individuals who do not qualify to request a.

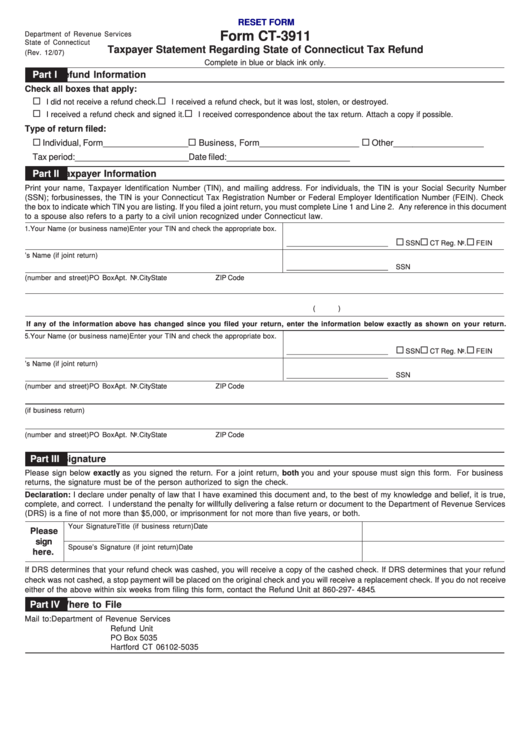

Fillable Form Ct3911 Taxpayer Statement Regarding State Of

If successful, the irs will issue a replacement check to the taxpayer. Form 3911 is also known as a taxpayer statement regarding refund. Web print your current name(s), taxpayer identification number (for individuals, this is your social security number, for businesses, it is your employer identification number) and address, including zip code. The form must be completed and mailed or.

2006 Form CT CT3911 Fill Online, Printable, Fillable, Blank pdfFiller

What is the irs refund trace process like? About your federal tax refund forif you did not receive your refund or if the refund check you received was lost, stolen or destroyed, complete the. More about the federal form 3911 we last updated federal form 3911 in december 2022 from the federal internal revenue service. While predominantly used for tax.

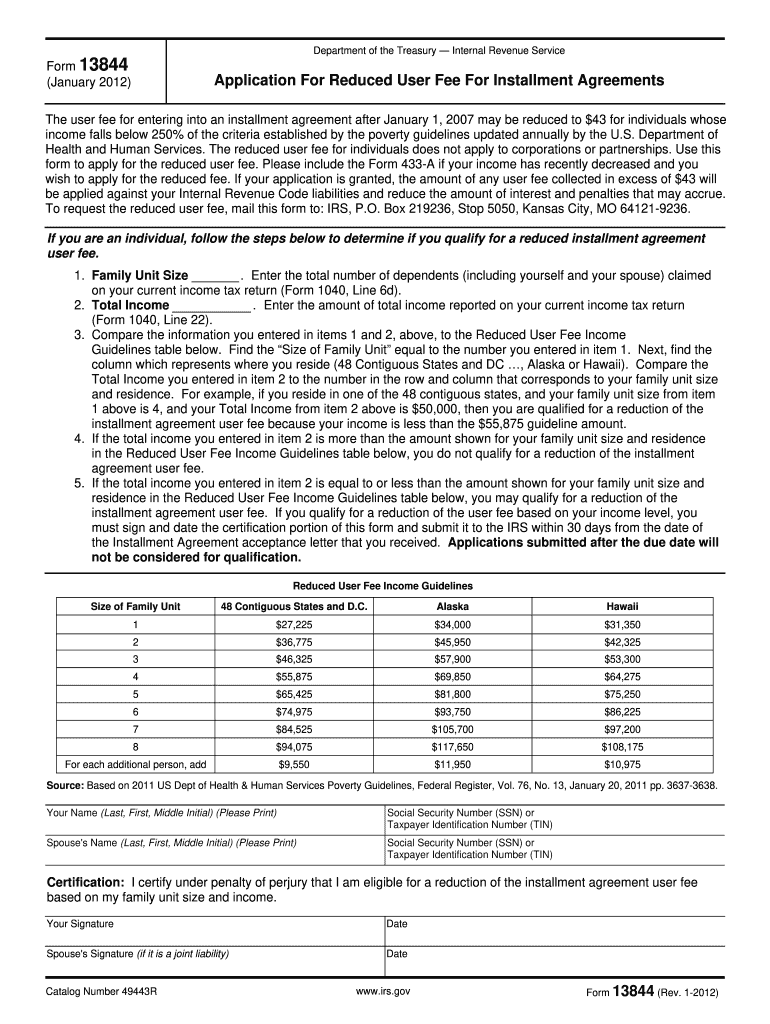

Irs form 13844 2012 Fill out & sign online DocHub

Married filing joint taxpayers must complete and jointly sign the form 3911 and return it to the irs before a refund trace can be initiated by the refund inquiry examiner. You need to complete form 3911, taxpayer statement regarding refund, and mail it to the irs address where you would normally file a paper tax return. More about the federal.

Irs Form 1310 Printable Master of Documents

Irfof provides the mailing address and fax number of the predetermined accounts management campus to mail the form 3911. Web go to “where’s my refund?” at irs.gov or use the irs2go mobile app and follow the prompts to begin a refund trace. By filing this form, the taxpayer initiates a refund trace. If successful, the irs will issue a replacement.

941 Worksheet 1 2020 Fillable Pdf

Web what is a form 3911, taxpayer statement regarding refund? While predominantly used for tax refunds, form 3911 has also been utilized for missing economic impact payments that were issued pursuant to the cares act. To complete this document, you'll need certain information about the. Married filing joint taxpayers must complete and jointly sign the form 3911 and return it.

A taxpayer completes this form to inquire about the status of an expected refund. Web regardless of the reason for never receiving your tax refund, filing form 3911 with the irs helps trace your refund to determine its whereabouts. Web what is a form 3911, taxpayer statement regarding refund? Form 3911 is used by a taxpayer who was issued a refund either by direct deposit or. More about the federal form 3911 we last updated federal form 3911 in december 2022 from the federal internal revenue service. Web irs form 3911, taxpayer statement regarding refund, is the tax form that a taxpayer may use to inform the irs of a missing tax refund. While predominantly used for tax refunds, form 3911 has also been utilized for missing economic impact payments that were issued pursuant to the cares act. By filing this form, the taxpayer initiates a refund trace. If successful, the irs will issue a replacement check to the taxpayer. The form must be completed and mailed or faxed to the specified irs office. Web information about form 3911, taxpayer statement regarding refund, including recent updates, related forms, and instructions on how to file. About your federal tax refund forif you did not receive your refund or if the refund check you received was lost, stolen or destroyed, complete the. Web print your current name(s), taxpayer identification number (for individuals, this is your social security number, for businesses, it is your employer identification number) and address, including zip code. To complete this document, you'll need certain information about the. Married filing joint taxpayers must complete and jointly sign the form 3911 and return it to the irs before a refund trace can be initiated by the refund inquiry examiner. The information below is in reply to your inquiry on. If your filing status is married filing jointly. Form 3911 is provided to individuals who do not qualify to request a replacement check through the internet, automated phone system or by contacting a customer service representative. This form is for income earned in tax year 2022, with tax returns due in april 2023. Form 3911 is also known as a taxpayer statement regarding refund.

Web Regardless Of The Reason For Never Receiving Your Tax Refund, Filing Form 3911 With The Irs Helps Trace Your Refund To Determine Its Whereabouts.

Web information about form 3911, taxpayer statement regarding refund, including recent updates, related forms, and instructions on how to file. Web go to “where’s my refund?” at irs.gov or use the irs2go mobile app and follow the prompts to begin a refund trace. About your federal tax refund forif you did not receive your refund or if the refund check you received was lost, stolen or destroyed, complete the. What is the irs refund trace process like?

If Your Filing Status Is Married Filing Jointly.

Form 3911 is used by a taxpayer who was issued a refund either by direct deposit or. By filing this form, the taxpayer initiates a refund trace. While predominantly used for tax refunds, form 3911 has also been utilized for missing economic impact payments that were issued pursuant to the cares act. Irfof provides the mailing address and fax number of the predetermined accounts management campus to mail the form 3911.

Form 3911 Is Provided To Individuals Who Do Not Qualify To Request A Replacement Check Through The Internet, Automated Phone System Or By Contacting A Customer Service Representative.

Web what is a form 3911, taxpayer statement regarding refund? You need to complete form 3911, taxpayer statement regarding refund, and mail it to the irs address where you would normally file a paper tax return. If successful, the irs will issue a replacement check to the taxpayer. Form 3911 is also known as a taxpayer statement regarding refund.

The Form Must Be Completed And Mailed Or Faxed To The Specified Irs Office.

Married filing joint taxpayers must complete and jointly sign the form 3911 and return it to the irs before a refund trace can be initiated by the refund inquiry examiner. Web print your current name(s), taxpayer identification number (for individuals, this is your social security number, for businesses, it is your employer identification number) and address, including zip code. This form is for income earned in tax year 2022, with tax returns due in april 2023. A taxpayer completes this form to inquire about the status of an expected refund.