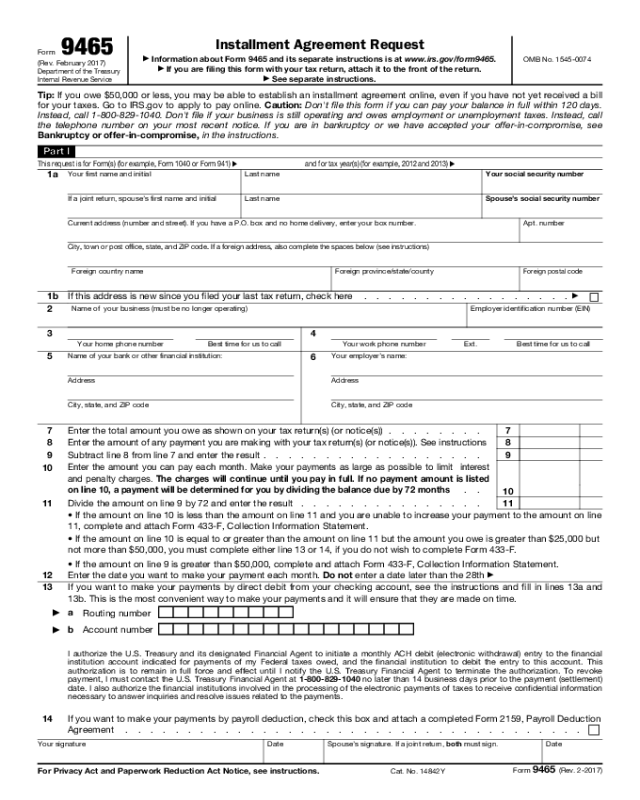

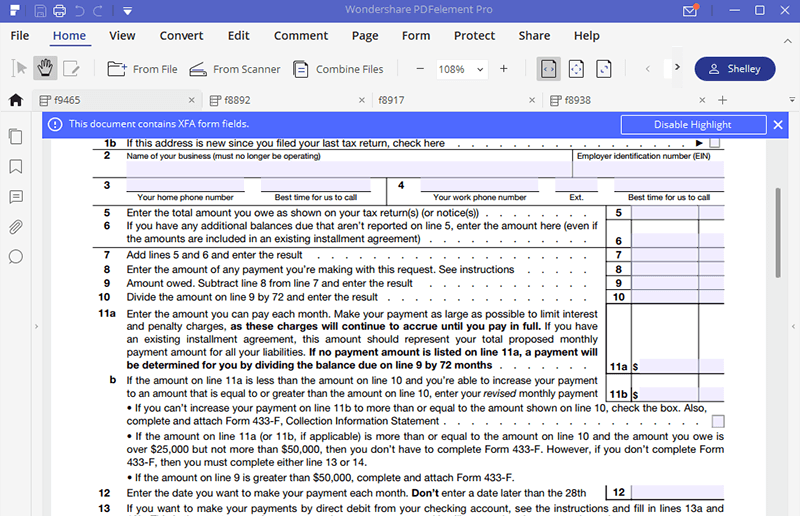

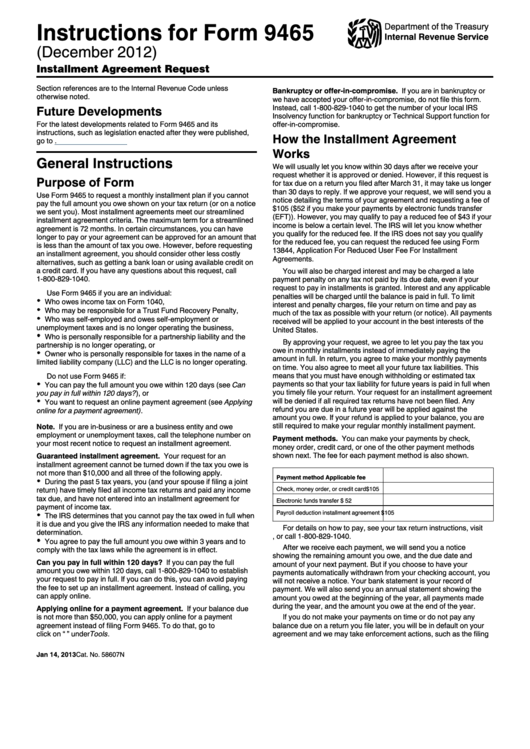

Irs Form 9465 Printable - Carefully read the instructions provided on the form to understand the requirements and guidelines for completing it accurately. The maximum term for a streamlined agreement is 72 months. If you owe $50,000 or less, you may be able to avoid filing form 9465 and establish an installment agreement online, even if you haven’t yet received a tax bill. December 2018) department of the treasury internal revenue service. Importance of irs form payment plan 9465 This form is for income earned in tax year 2022, with tax returns due in april 2023. Do not file this form if you are currently making payments on an installment agreement. Web we last updated the installment agreement request in january 2023, so this is the latest version of form 9465, fully updated for tax year 2022. Web irs form 9465 ≡ fill out printable pdf forms online home fillable pdf forms irs form 9465 irs form 9465 get form now edit fill out sign export or print download your fillable irs form 9465 in pdf table of contents purposes and main requirements who can apply contract guarantee installment agreement definitions and rules where to apply Click print, then click the pdf link that is provided for printing.

How Do I Set Up an Installment Agreement; IRS Just Sent Me Form 9465

Web instructions for form 9465 (rev. Begin by downloading irs form 9465 from the official website or obtain a physical copy from a local irs office, if available. This request is for form(s) (for example, form 1040 or form 941) and for tax year(s) (for example, 2010 and 2011) Most installment agreements meet our streamlined installment agreement criteria. Click print,.

Instructions For Form 9465 (Rev. December 2012) printable pdf download

The irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. If you are filing this form with your tax return, attach it to the front of the return. If you are filing this form with your tax return, attach it to the front of the return. Web form.

Irs Form 9465 Fs Universal Network

Web internal revenue service see separate instructions. Web form 9465 installment agreement request (rev. Businesses can only use this form if they are out of business. You can download and print the form, or you can fill it out online using the irs online payment agreement tool. The following taxpayers can use form 9465 to request a payment plan:

IRS Form 9465 [Can't Pay Your Taxes All At Once? READ THIS]

In most cases, it is a good idea to pay a portion of your tax debt before asking for payment assistance from the irs for the leftover balance. If you are filing this form with your tax return, attach it to the front of the return. You can download and print the form, or you can fill it out online.

Form 9465 Edit, Fill, Sign Online Handypdf

Web instructions for form 9465 (rev. They will request through this form so that they can submit their taxes in monthly installments. Web irs form payment plan 9465 is a document you can file to request said payment plan. December 2018) department of the treasury internal revenue service. Web internal revenue service see separate instructions.

Irs Forms 9465 Form Resume Examples emVKGjjVrX

It is a good idea to at least pay a portion of our tax debt before asking for the payment plan. The maximum term for a streamlined agreement is 72 months. Go to www.irs.gov/opa to apply for an online payment agreement. The following taxpayers can use form 9465 to request a payment plan: Web information about form 9465, installment agreement.

Irs Fillable Form 1040 / Fillable Form P 1040 Es Estimated Tax For

Carefully read the instructions provided on the form to understand the requirements and guidelines for completing it accurately. With this form, you can arrange to pay what you owe within 60 months. Your best solution to fill in irs form 9465 From within your taxact return ( online ), click the print center dropdown, then click custom print. If you.

Form 9465. Installment Agreement Request Fill out & sign online DocHub

Web open the irs form 9465 printable and follow the instructions easily sign the irs 9465 with your finger send filled & signed form 9465 irs or save rate the irs form 9465 online 4.8 satisfied 196 votes what makes the irs form 9465 printable legally binding? Click print, then click the pdf link that is provided for printing. Web.

Irs Form 9465 Fillable and Editable PDF Template

If you are filing this form with your tax return, attach it to the front of the return. Web you can find irs form 9465 on the official website of the internal revenue service (irs). October 2020) installment agreement request (for use with form 9465 (rev. September 2020)) department of the treasury internal revenue service section references are to the.

Filling Out Money Order For Taxes Make Money Taking Surveys App

Click print, then click the pdf link that is provided for printing. Importance of irs form payment plan 9465 Web you can find irs form 9465 on the official website of the internal revenue service (irs). Web all pages of form 9465 are available on the irs website. February 2017) installment agreement request information about form 9465 and its separate.

Web instructions for form 9465 (rev. You can download and print the form, or you can fill it out online using the irs online payment agreement tool. Web irs form 9465 ≡ fill out printable pdf forms online home fillable pdf forms irs form 9465 irs form 9465 get form now edit fill out sign export or print download your fillable irs form 9465 in pdf table of contents purposes and main requirements who can apply contract guarantee installment agreement definitions and rules where to apply September 2020)) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Web form 9465 is primarily for individuals. It is a good idea to at least pay a portion of our tax debt before asking for the payment plan. Your best solution to fill in irs form 9465 Web irs form 9465 is made for those people who are not able to pay their taxes in a single installment. Importance of irs form payment plan 9465 December 2018) department of the treasury internal revenue service. Do not file this form if you are currently making payments on an installment agreement. In most cases, it is a good idea to pay a portion of your tax debt before asking for payment assistance from the irs for the leftover balance. Web all pages of form 9465 are available on the irs website. Web form 9465 is a document you can file to formally request a monthly installment payment plan in the event you cannot pay what you owe from your federal tax return. The irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. Go to www.irs.gov/opa to apply for an online payment agreement. Web you can find irs form 9465 on the official website of the internal revenue service (irs). The following taxpayers can use form 9465 to request a payment plan: October 2020) installment agreement request (for use with form 9465 (rev. This request is for form(s) (for example, form 1040 or form 941) and for tax year(s) (for example, 2010 and 2011)

Web Information About Form 9465, Installment Agreement Request, Including Recent Updates, Related Forms And Instructions On How To File.

Web use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay your full tax due amount. Form 9465 is available in all versions of taxact ®. Click print, then click the pdf link that is provided for printing. Begin by downloading irs form 9465 from the official website or obtain a physical copy from a local irs office, if available.

You Can Download And Print The Form, Or You Can Fill It Out Online Using The Irs Online Payment Agreement Tool.

More about the federal form 9465 we last updated federal form 9465 in january 2023 from the federal internal revenue service. October 2020) installment agreement request (for use with form 9465 (rev. With this form, you can arrange to pay what you owe within 60 months. The irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance.

Web You Can Find Irs Form 9465 On The Official Website Of The Internal Revenue Service (Irs).

In most cases, it is a good idea to pay a portion of your tax debt before asking for payment assistance from the irs for the leftover balance. If you owe $50,000 or less in taxes, penalties, and interest, it's also possible to avoid filing form 9465 and complete an online payment. Web irs form 9465 ≡ fill out printable pdf forms online home fillable pdf forms irs form 9465 irs form 9465 get form now edit fill out sign export or print download your fillable irs form 9465 in pdf table of contents purposes and main requirements who can apply contract guarantee installment agreement definitions and rules where to apply Your best solution to fill in irs form 9465

Web All Pages Of Form 9465 Are Available On The Irs Website.

Most installment agreements meet our streamlined installment agreement criteria. If you are filing this form with your tax return, attach it to the front of the return. From within your taxact return ( online ), click the print center dropdown, then click custom print. Carefully read the instructions provided on the form to understand the requirements and guidelines for completing it accurately.

![IRS Form 9465 [Can't Pay Your Taxes All At Once? READ THIS]](https://help.taxreliefcenter.org/wp-content/uploads/2018/04/9465-usa-federal-tax-form-form-9465-instructions-ss-768x501.jpg)