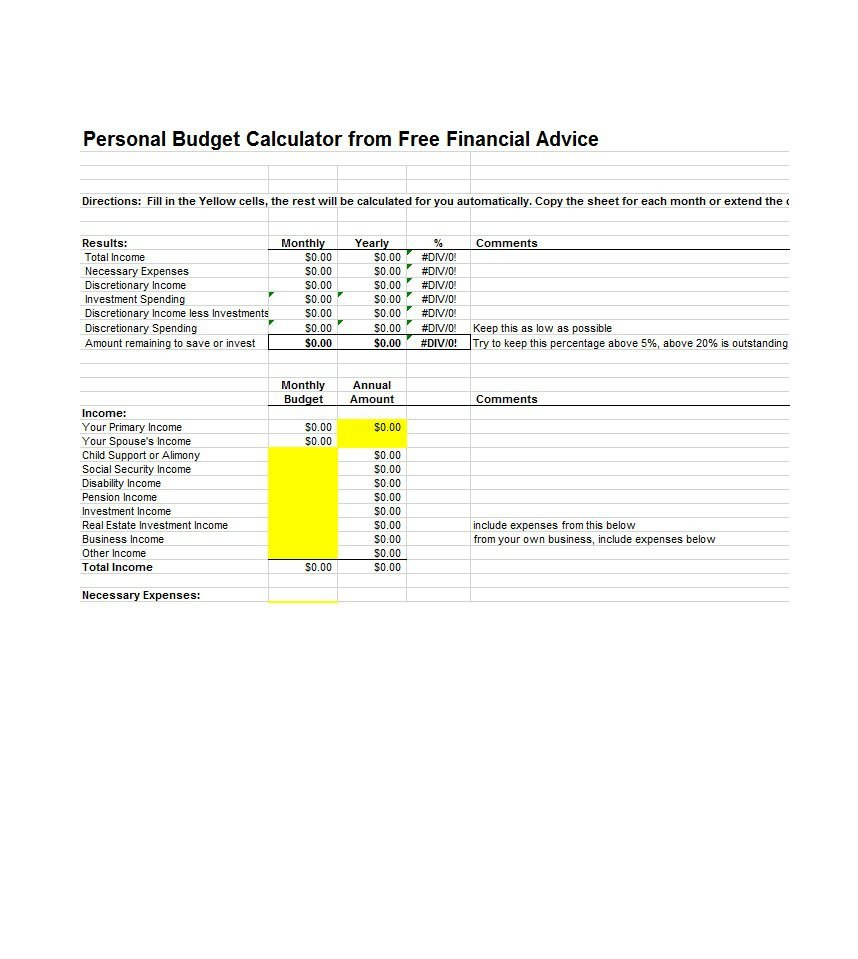

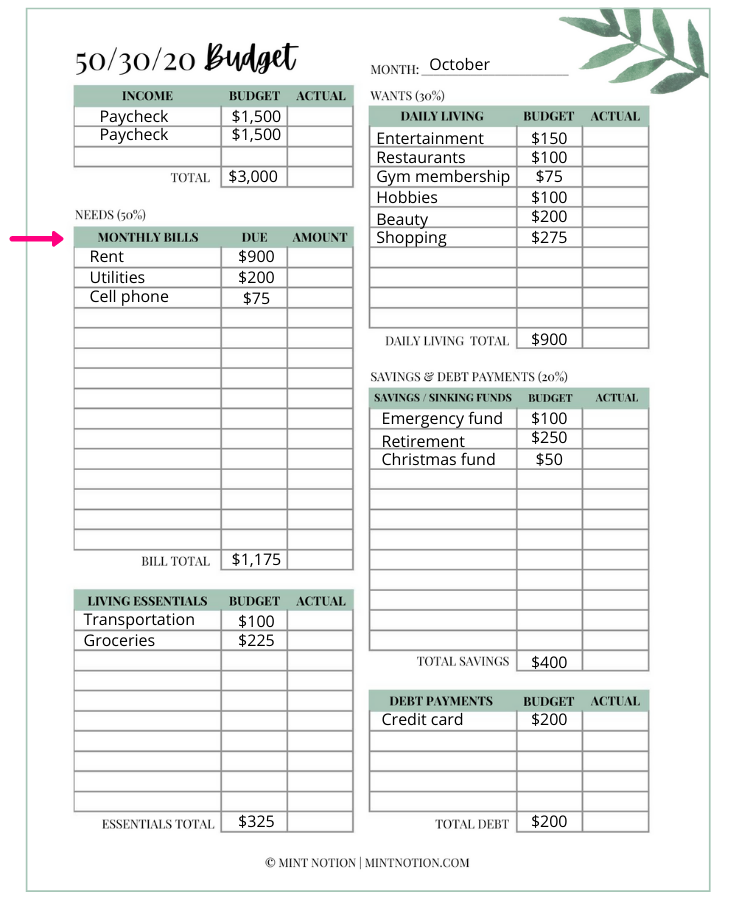

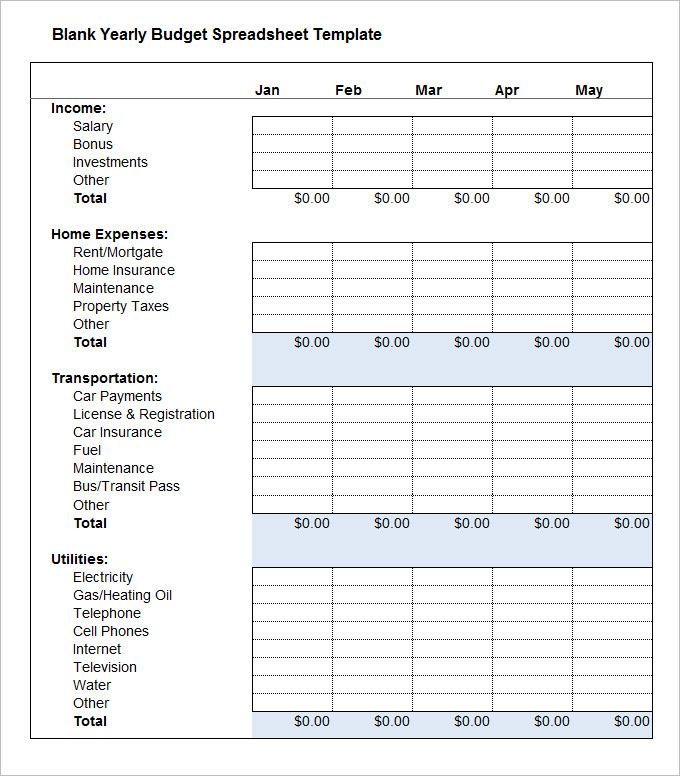

Printable 50/30/20 Budget Template - Web google sheets budget templates how it works: Get your 50/30/20 budget template today. Customize this list on the categories sheet in the foundation template. Printable 50 30 20 budget calculator; Achieve financial balance and security with template.net's 50 30 20 budget template. Web 50/30/20 budget template summary. 50% for needs, 30% for wants, 20% for savings and debt. Web what is the 50 30 20 rule? Add your income and expenses to this monthly budget template, and we'll show how your spending aligns with the 50/30/20 rule. Works on both mac and windows;.

50 30 20 Budget Spreadsheet Template Google Spreadshee 50 30 20 budget

Web 50/30/20 budget planner, savings tracker, money management printable, saving rule pdf in a4, a5 and letter size. If you have health insurance, retirement contributions, or any other savings deducted from your paycheck, simply add them back in. Figure out your total monthly income; $720 (401k and hsa) total income: Easy to export budget pdf;

50 30 20 Budget Template serat

Google drive is a file storage service where users can create, upload and share files. If you think it will work for you, you can even download our printable majority monthly budget worksheet for free. Customize this list on the categories sheet in the foundation template. Got it as soon as i paid for it, and the quality is awesome!.

503020 Budget Rule and Spreadsheet (with Examples) She Saves She

Needs, wants, and savings, so you can live comfortably while saving for your future. This free monthly budget template divides your monthly budget into needs/wants/savings to ensure that you are within the guidelines. Who is this budget method for? Web percentages for your budget. Visual dashboard to analyze savings;

MonthlyBudget.pdf Monthly budget printable, Budget planner template

50% for needs, 30% for wants, 20% for savings and debt. Each category should also be assigned to a group. It also compares your monthly budget to your actual spending. Web we offer a free 50/30/20 calculator and spreadsheet to calculate your savings according to this rule. Ideally, this is what you should be spending each month on your needs,.

50/30/20 Budget Rule Free Budget Spreadsheet Healthy Wealthy Skinny

If you think it will work for you, you can even download our printable majority monthly budget worksheet for free. Needs, wants, and savings, so you can live comfortably while saving for your future. Compute your monthly household income your monthly income is what you bring home after taxes. Brianna adkins dec 12, 2022. Easy to export budget pdf;

Is the 503020 Budget a Good Budget for You?

Printable 50 30 20 budget calculator; Item quality 5.0 shipping 5.0 customer service 5.0 i love using the budget pdf. Compute your monthly household income your monthly income is what you bring home after taxes. Web 50/30/20 budget template summary. Super easy to print as well.

50 30 20 Budget Template serat

Add your income and expenses to this monthly budget template, and we'll show how your spending aligns with the 50/30/20 rule. Follow along for a quick budget example. 50% to “needs,” 30% to “wants,” and 20% to your financial goals. 50/30/20 budget overview template printable, monthly budget planner 50/30/20 rule, income & expense money management worksheet, cash flow. To use.

Printable budget templates and free, blank budget worksheets forms

Web free budget planner worksheet. Follow along for a quick budget example. Web we offer a free 50/30/20 calculator and spreadsheet to calculate your savings according to this rule. Needs 50% or $1990, wants 30% or $1194, savings & debts 20% or $796. Got it as soon as i paid for it, and the quality is awesome!

What is the 50/30/20 Budget Rule and How it Works Mint Notion

Printable 50 30 20 budget calculator; Web what is the 50 30 20 rule? 50% for your needs, 30% for your wants and 20% for your savings. You’ll deduct them again when placing them in their respective category. Needs 50% or $1990, wants 30% or $1194, savings & debts 20% or $796.

Personal Annual Budget Template For Your Needs

Web it sounds harder than it is. Web simple steps for creating a 50/30/20 budget in your foundation template first, think about your categories and how you spend and earn your money. Follow along for a quick budget example. Customize this list on the categories sheet in the foundation template. If you have health insurance, retirement contributions, or any other.

Web google sheets budget templates how it works: Needs wants savings and debt repayment 50% to “needs,” 30% to “wants,” and 20% to your financial goals. 50/30/20 budget overview template printable, monthly budget planner 50/30/20 rule, income & expense money management worksheet, cash flow. You’ll deduct them again when placing them in their respective category. There are multiple slides provided in the set to let you pick the most suitable one for your existing or next presentations. What budget apps work with the 50 / 30 /. To use the 50/30/20 budget. Add your income and expenses to this monthly budget template, and we'll show how your spending aligns with the 50/30/20 rule. Who is this budget method for? This free monthly budget template divides your monthly budget into needs/wants/savings to ensure that you are within the guidelines. Printable 50 30 20 budget calculator; How do you pay off debt with a 50 / 20 / 30 budget? Web 50/30/20 budget planner, savings tracker, money management printable, saving rule pdf in a4, a5 and letter size. Web percentages for your budget. Web 50/30/20 budget template summary. Item quality 5.0 shipping 5.0 customer service 5.0 i love using the budget pdf. How to set up a 50 / 30 / 20 budget. Achieve financial balance and security with template.net's 50 30 20 budget template. Get 15gb of storage for free or upgrade if that's not enough.

50% For Needs, 30% For Wants, 20% For Savings And Debt.

At the end of the year, i look back on the sheet and compare to my budget binder and see how i did for the year. Visual dashboard to analyze savings; Add your income and expenses to this monthly budget template, and we'll show how your spending aligns with the 50/30/20 rule. Figure out your total monthly income;

50/30/20 Budget Overview Template Printable, Monthly Budget Planner 50/30/20 Rule, Income & Expense Money Management Worksheet, Cash Flow.

Many experts agree that one simple way to budget is to divide your income into three parts: Then, divide the money into 50% for needs, 30% for wants, and 20% for savings. When entering the numbers it does the math for you. Google drive is a file storage service where users can create, upload and share files.

If You Think It Will Work For You, You Can Even Download Our Printable Majority Monthly Budget Worksheet For Free.

Customize this list on the categories sheet in the foundation template. Each category should also be assigned to a group. If you have health insurance, retirement contributions, or any other savings deducted from your paycheck, simply add them back in. How do you pay off debt with a 50 / 20 / 30 budget?

Web Simple Steps For Creating A 50/30/20 Budget In Your Foundation Template First, Think About Your Categories And How You Spend And Earn Your Money.

To use the 50/30/20 budget. 50% of net pay for needs, 30% for wants and 20% for savings and debt repayment. You’ll deduct them again when placing them in their respective category. This planner will assist you with organizing your finances, tracking your finances and achieving those savings goals.