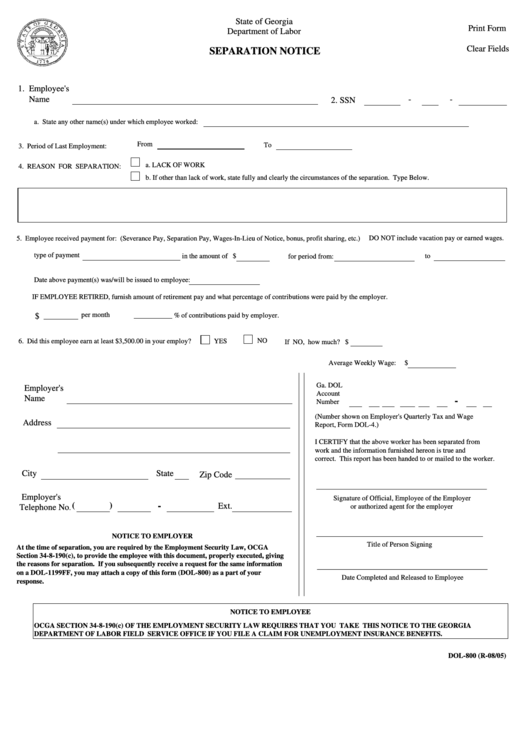

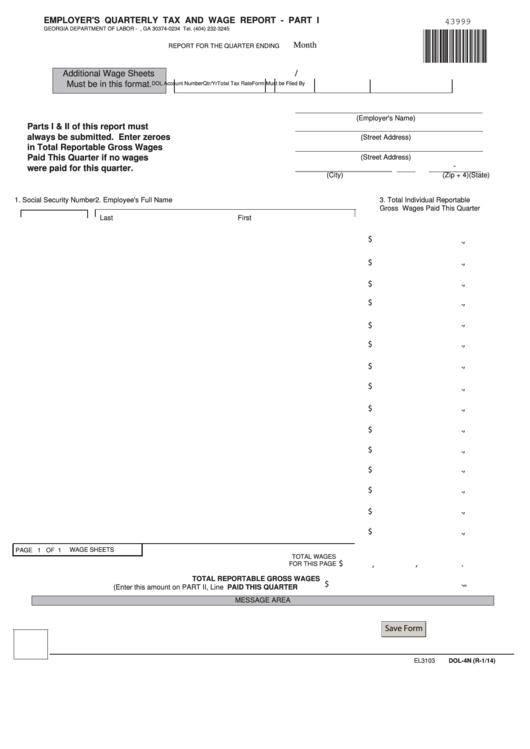

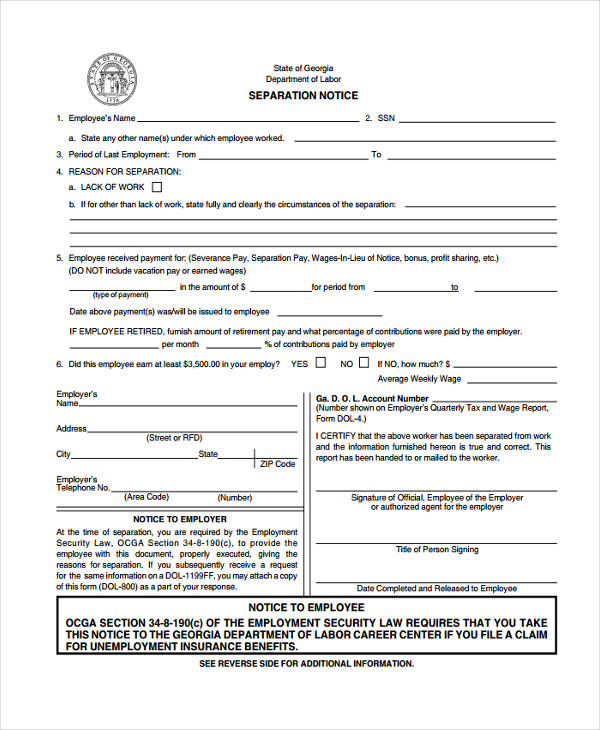

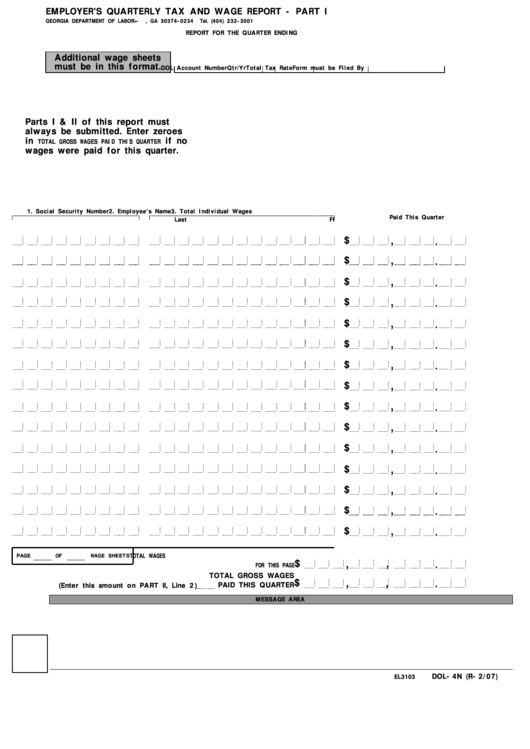

Printable Form Dol-4N - An upload file formatted to meet dol standards as either a.csv or magnetic media file type. Select the appropriate filing quarter. Write or type the required information on the hardcopy and. (please print clearly) $ unless parts i & ii of this report are filed and the total amount Sign and mail the report, parts i and ii, by the due date. Serves to catch and record identity authentication, time and date stamp, and ip. Generic state quarterly unemployment compensation and wage report Save or instantly send your ready documents. You can complete some forms online, while you can download and print all others. Dol account number qtr/yr total tax rate form must be filed by (1st month) (2nd month) (3rd month).

20 Department Of Labor Forms And Templates free to download in PDF

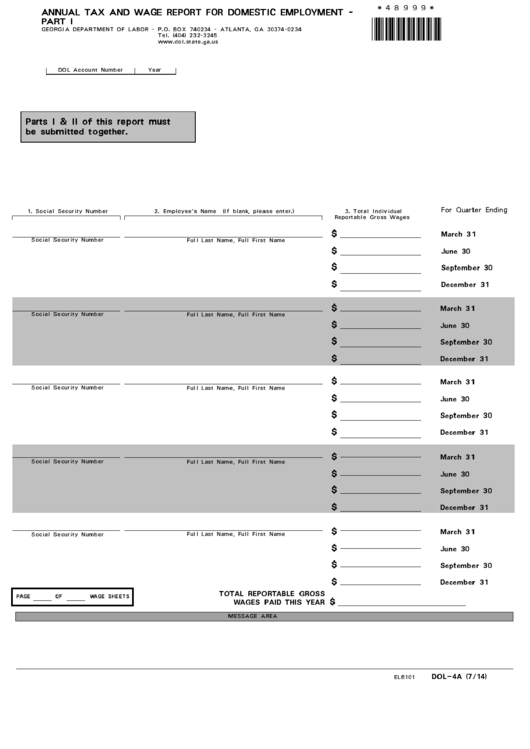

Web annual tax and wage report which domestic employers must file. Write or type the required information on the hardcopy and. Adhering to these guidelines will ensure timely processing of your reports. The annual report and any payment due must be filed on or before january 31st of the following year to be considered timely.this form is interactive and can.

Form Dol4n Employer'S Quarterly Tax And Wage Report

Save or instantly send your ready documents. They are likewise a simple method to get information from your customers. Year 2000 naswa unemployment insurance code “s” supplemental record format as defined by the georgia department of labor for direct wage reporting by electronic media. Web home forms forms these are the most frequently requested u.s. Write or type the required.

20152020 Form DoL WH380E Fill Online, Printable, Fillable, Blank

Simply click on the appropriate form and print it using the [print] button provided near the top of the form. Read the guidelines to determine which info you need to include. Web hey there, @jlsc. Web annual tax and wage report which domestic employers must file. You can also download it, export it or print it out.

DoL CA20 20142021 Fill and Sign Printable Template Online US

Web annual tax and wage report which domestic employers must file. Save or instantly send your ready documents. Choose the form you want in the collection of legal forms. Read the guidelines to determine which info you need to include. Dol account number qtr/yr total tax rate form must be filed by (1st month) (2nd month) (3rd month).

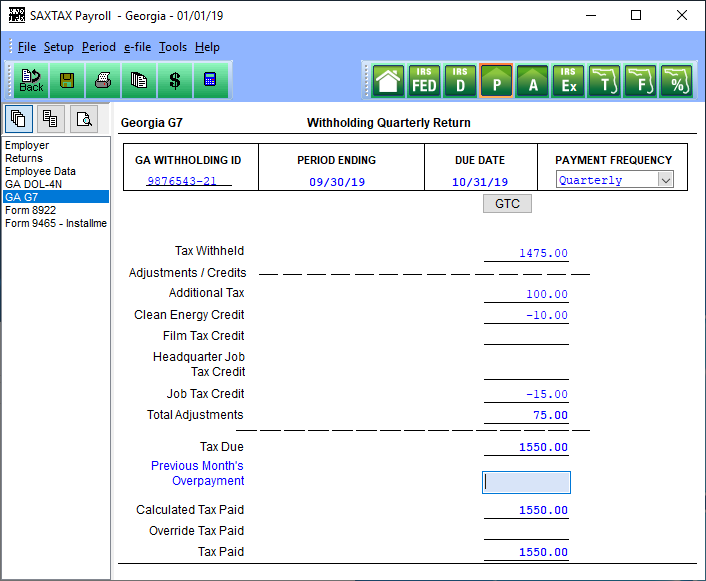

DOL4N Employer’s Tax and Wage Report SAXTAX

Sign and mail the report, parts i and ii, by the due date. You can complete some forms online, while you can download and print all others. Web follow these simple instructions to get dol4n prepared for sending: Choose the form you want in the collection of legal forms. Read the guidelines to determine which info you need to include.

form dol 4 Oker.whyanything.co

Dol account number qtr/yr total tax rate form must be filed by (1st month) (2nd month) (3rd month). An upload file formatted to meet dol standards as either a.csv or magnetic media file type. Serves to catch and record identity authentication, time and date stamp, and ip. The annual report and any payment due must be filed on or before.

Form Dol4n Employer'S Quarterly Tax And Wage Report

You can also download it, export it or print it out. In the top section of the form, you must select the quarter ending month, enter the year, and your georgia department of labor (gdol) account. Write or type the required information on the hardcopy and. They are likewise a simple method to get information from your customers. The annual.

WA DoL TD420041 20182022 Fill and Sign Printable Template Online

Transmits the data safely to the servers. You can also download it, export it or print it out. An upload file formatted to meet dol standards as either a.csv or magnetic media file type. Year 2000 naswa unemployment insurance code “s” supplemental record format as defined by the georgia department of labor for direct wage reporting by electronic media. Web.

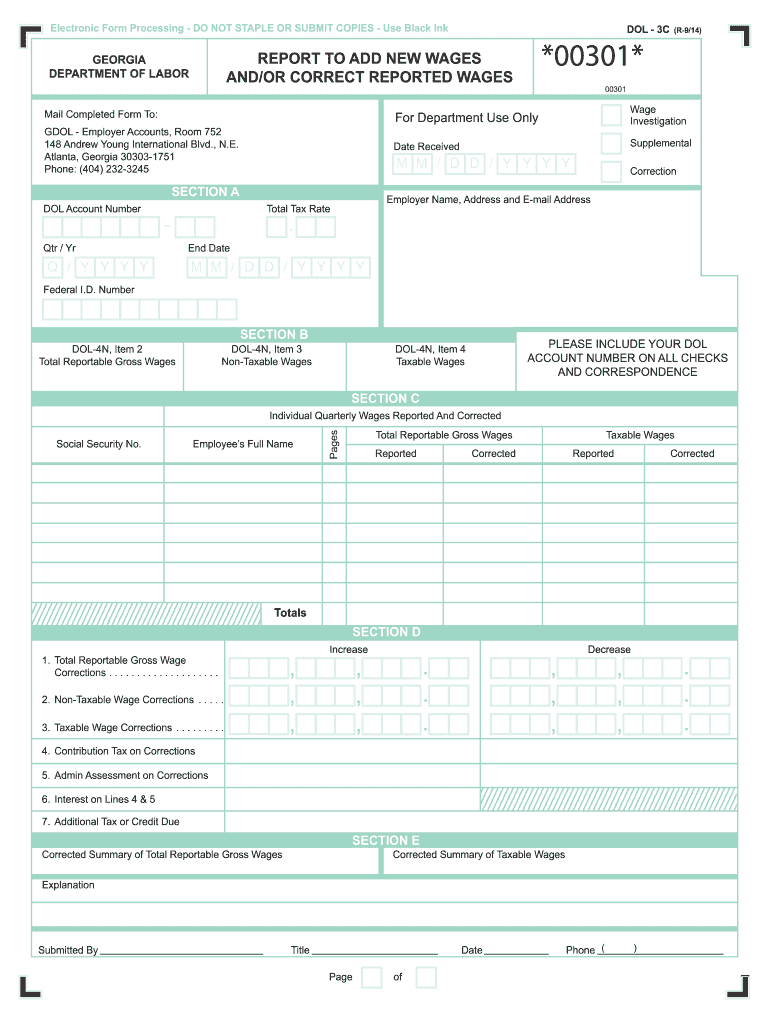

Dol 3C Fill Out and Sign Printable PDF Template signNow

The annual report and any payment due must be filed on or before january 31st of the following year to be considered timely.this form is interactive and can be completed electronically and printed. Select the appropriate filing quarter. Web follow these simple instructions to get dol4n prepared for sending: Adhering to these guidelines will ensure timely processing of your reports..

20 Department Of Labor Forms And Templates free to download in PDF

Complete one or more of these forms separately for each quarterly report that is to be corrected. Open the form in the online editor. Dol account number qtr/yr total tax rate form must be filed by (1st month) (2nd month) (3rd month). Adhering to these guidelines will ensure timely processing of your reports. The annual report and any payment due.

Web home forms forms these are the most frequently requested u.s. Write or type the required information on the hardcopy and. You can complete some forms online, while you can download and print all others. Sign and mail the report, parts i and ii, by the due date. An upload file formatted to meet dol standards as either a.csv or magnetic media file type. Generic state quarterly unemployment compensation and wage report Read the guidelines to determine which info you need to include. Adhering to these guidelines will ensure timely processing of your reports. The annual report and any payment due must be filed on or before january 31st of the following year to be considered timely.this form is interactive and can be completed electronically and printed. Web annual tax and wage report which domestic employers must file. Web the form is designed to: See georgia department of labor electronic media specifications for quarterly tax and wage reporting for more information about these standards. You can upgrade to the latest version of adobe reader from www.adobe.com. The best way to edit georgia department of labor in pdf format online Dol account number qtr/yr total tax rate form must be filed by (1st month) (2nd month) (3rd month). Select the appropriate filing quarter. Filling out the dol4n printable form with signnow will give greater confidence that the output template will be legally binding and safeguarded. Open the form in the online editor. Web to view the full contents of this document, you need a later version of the pdf viewer. Save or instantly send your ready documents.

Simply Click On The Appropriate Form And Print It Using The [Print] Button Provided Near The Top Of The Form.

Easily fill out pdf blank, edit, and sign them. Write or type the required information on the hardcopy and. Generic state quarterly unemployment compensation and wage report Sign and mail the report, parts i and ii, by the due date.

Total Record Length = 275 (276 If Necessary) For Each.

An upload file formatted to meet dol standards as either a.csv or magnetic media file type. Serves to catch and record identity authentication, time and date stamp, and ip. You can complete some forms online, while you can download and print all others. Choose the form you want in the collection of legal forms.

Web The Form Is Designed To:

See georgia department of labor electronic media specifications for quarterly tax and wage reporting for more information about these standards. You can also download it, export it or print it out. Read the guidelines to determine which info you need to include. In the top section of the form, you must select the quarter ending month, enter the year, and your georgia department of labor (gdol) account.

Dol Account Number Qtr/Yr Total Tax Rate Form Must Be Filed By (1St Month) (2Nd Month) (3Rd Month).

Web to view the full contents of this document, you need a later version of the pdf viewer. They are likewise a simple method to get information from your customers. The annual report and any payment due must be filed on or before january 31st of the following year to be considered timely.this form is interactive and can be completed electronically and printed. It ending up being more and more prominent amongst organizations of.