Printable Kentucky State Tax Forms - Kentucky has a state income tax of 5%. Utility gross receipts license tax; The current tax year is 2022, with tax returns due in april 2023. Motor vehicle rental/ride share excise tax; Web all kentucky wage earners are taxed at a flat 5% rate with a standard deduction allowance of $2,690. Taxformfinder provides printable pdf copies of 130 current kentucky income tax forms. The current tax year is 2022, and most states will release updated tax forms between january and april of 2023. The department of revenue annually adjust the standard deduction in accordance with krs 141.081(2)(a). Please click here to see if you are required to report kentucky use tax on your individual income tax return. Web the 2021 threshold amount is $12,880 for a family size of one, $17,420 for a family of two, $21,960 for a family of three, and $26,500 for a family of four or more.

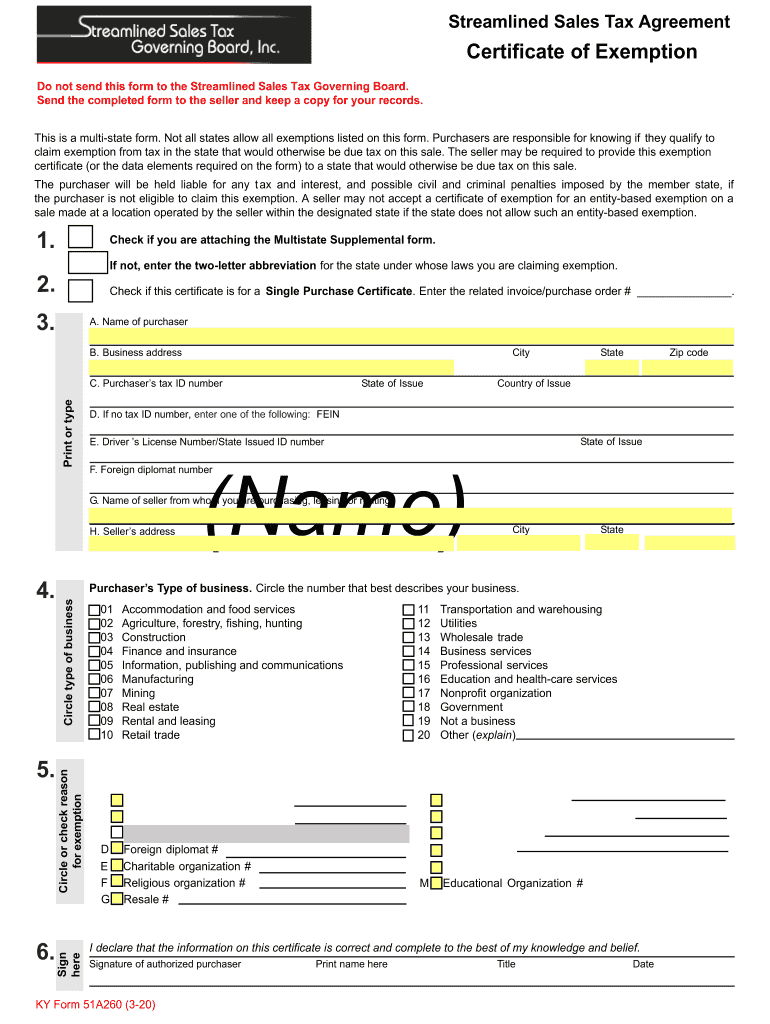

Revenue form 51a260 Fill out & sign online DocHub

Web the 2021 threshold amount is $12,880 for a family size of one, $17,420 for a family of two, $21,960 for a family of three, and $26,500 for a family of four or more. Tobacco and vapor products taxes; Motor vehicle rental/ride share excise tax; The current tax year is 2022, and most states will release updated tax forms between.

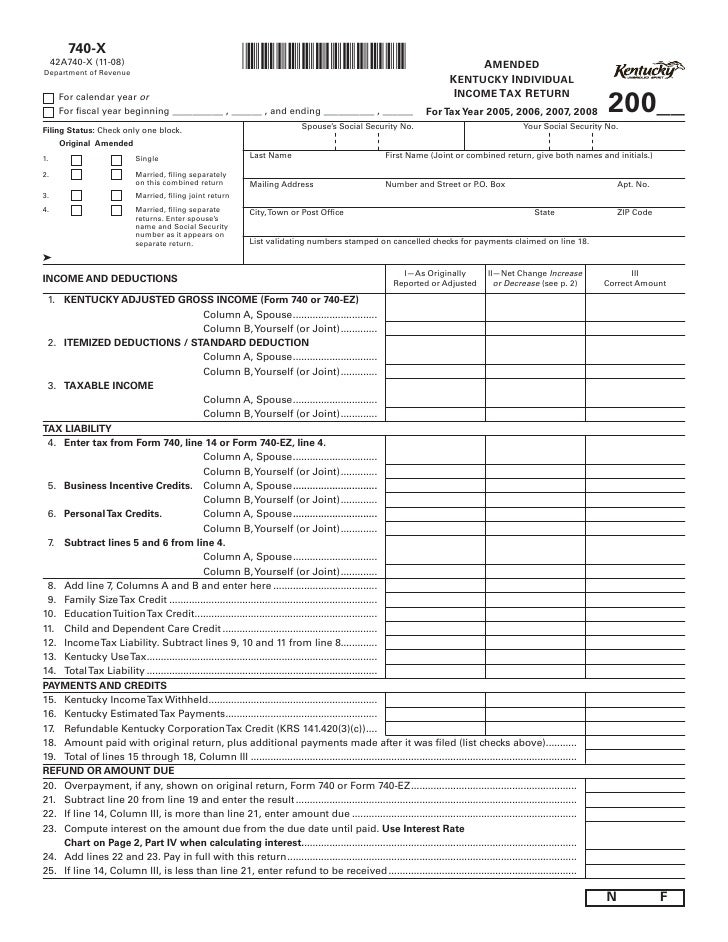

740X Amended Kentucky Individual Tax Return for Tax Year 20…

Kentucky has a state income tax of 5%. • kentucky income tax payments currently due on april 15, 2020, may 15, 2020, and june 15, 2020 for individual, Web printable income tax forms. The department of revenue annually adjust the standard deduction in accordance with krs 141.081(2)(a). The current tax year is 2022, and most states will release updated tax.

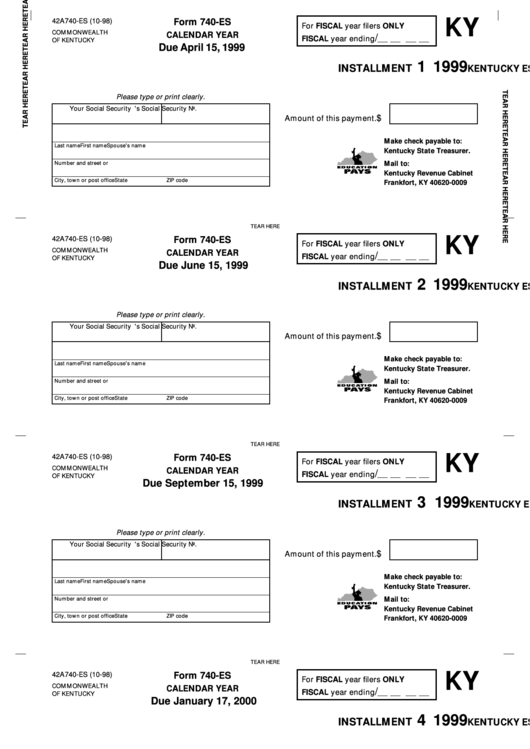

Fillable Form 740Es Kentucky Estimated Tax Voucher 1999 printable

Taxformfinder provides printable pdf copies of 130 current kentucky income tax forms. Web use tax on individual income tax return. Utility gross receipts license tax; Kentucky income tax liability is not expected this year (see instructions) ̈ 2. Web printable income tax forms.

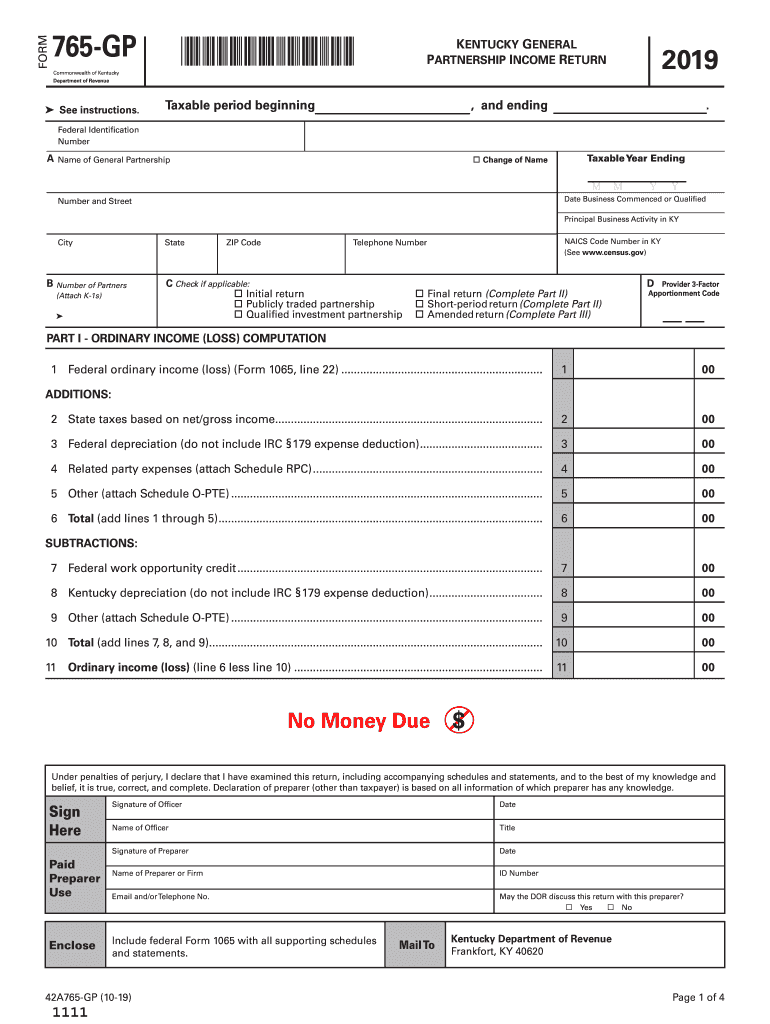

Ky Form 765 Gp Fill Out and Sign Printable PDF Template signNow

The current tax year is 2022, with tax returns due in april 2023. Taxformfinder provides printable pdf copies of 130 current kentucky income tax forms. Tobacco and vapor products taxes; Web kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue. Utility gross receipts license tax;

Printable Kentucky State Tax Forms Printable World Holiday

• kentucky income tax payments currently due on april 15, 2020, may 15, 2020, and june 15, 2020 for individual, Taxformfinder provides printable pdf copies of 130 current kentucky income tax forms. It was only available for tax years 2019 and 2020. Tobacco and vapor products taxes; Web kentucky has a flat state income tax of 5% , which is.

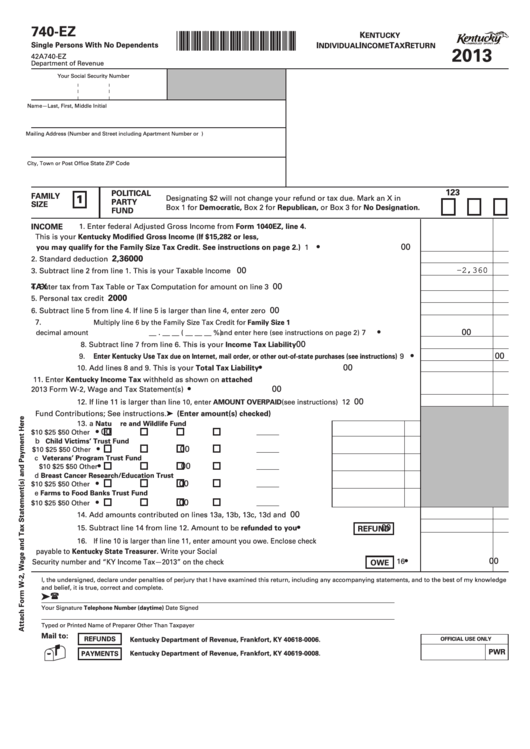

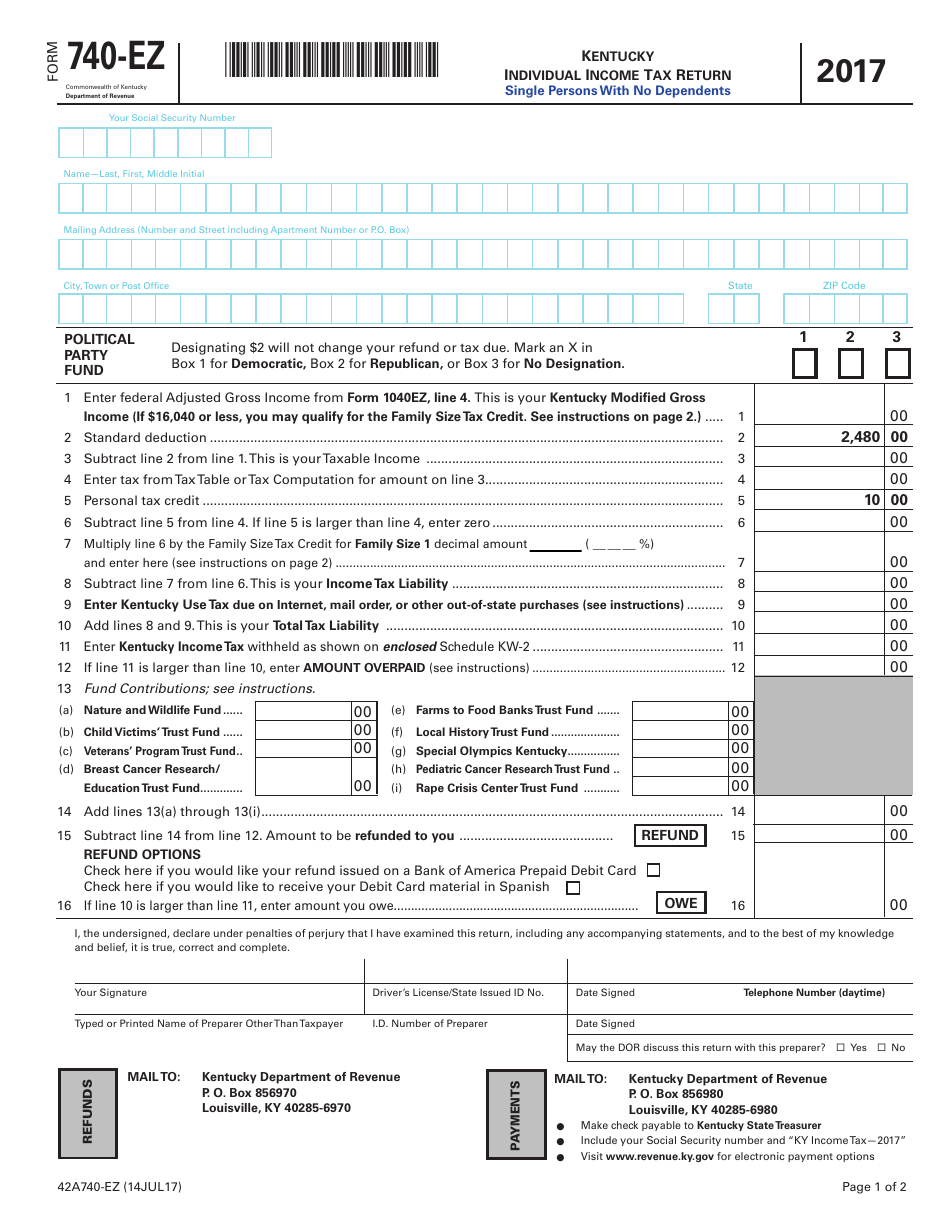

Fillable Form 740Ez Kentucky Individual Tax Return 2013

Web the 2021 threshold amount is $12,880 for a family size of one, $17,420 for a family of two, $21,960 for a family of three, and $26,500 for a family of four or more. Tobacco and vapor products taxes; Web kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue. The.

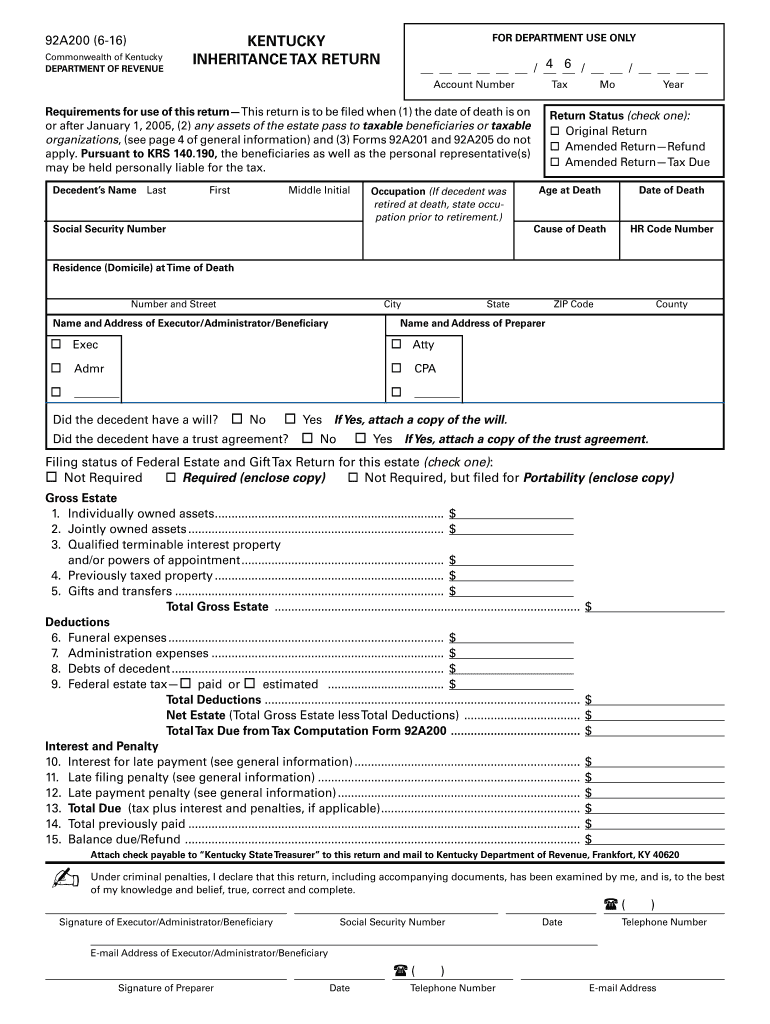

KY DoR 92A200 2016 Fill out Tax Template Online US Legal Forms

Taxformfinder provides printable pdf copies of 130 current kentucky income tax forms. Tobacco and vapor products taxes; • kentucky income tax payments currently due on april 15, 2020, may 15, 2020, and june 15, 2020 for individual, Web the 2021 threshold amount is $12,880 for a family size of one, $17,420 for a family of two, $21,960 for a family.

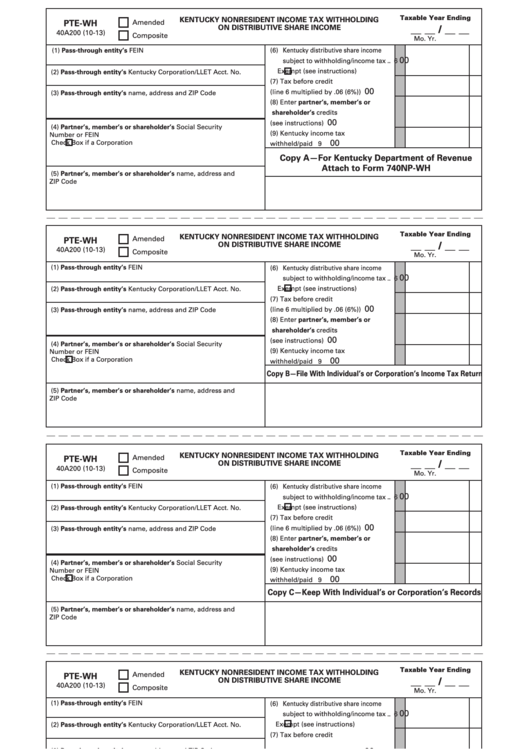

Form PteWh (State Form 40a200) Kentucky Nonresident Tax

Web the 2021 threshold amount is $12,880 for a family size of one, $17,420 for a family of two, $21,960 for a family of three, and $26,500 for a family of four or more. Tobacco and vapor products taxes; Taxformfinder provides printable pdf copies of 130 current kentucky income tax forms. The department of revenue annually adjust the standard deduction.

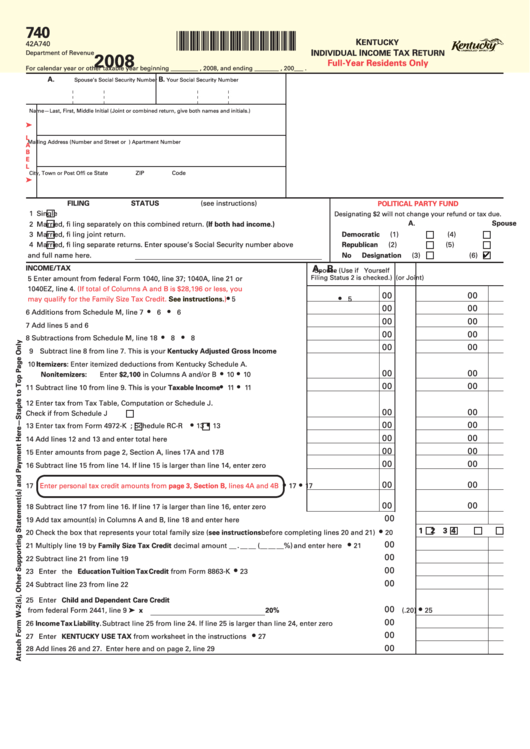

Fillable Form 740 Kentucky Individual Tax Return FullYear

Income gap tax credit—this credit has expired. It was only available for tax years 2019 and 2020. Tobacco and vapor products taxes; Web the 2021 threshold amount is $12,880 for a family size of one, $17,420 for a family of two, $21,960 for a family of three, and $26,500 for a family of four or more. • kentucky income tax.

Form 740EZ Download Fillable PDF or Fill Online Kentucky Individual

Motor vehicle rental/ride share excise tax; The current tax year is 2022, and most states will release updated tax forms between january and april of 2023. Web printable income tax forms. Income gap tax credit—this credit has expired. Web kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue.

Income gap tax credit—this credit has expired. Web the 2021 threshold amount is $12,880 for a family size of one, $17,420 for a family of two, $21,960 for a family of three, and $26,500 for a family of four or more. The current tax year is 2022, with tax returns due in april 2023. Tobacco and vapor products taxes; Please click here to see if you are required to report kentucky use tax on your individual income tax return. Web use tax on individual income tax return. Web all kentucky wage earners are taxed at a flat 5% rate with a standard deduction allowance of $2,690. Motor vehicle rental/ride share excise tax; Web kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue. The department of revenue annually adjust the standard deduction in accordance with krs 141.081(2)(a). It was only available for tax years 2019 and 2020. Kentucky income tax liability is not expected this year (see instructions) ̈ 2. Kentucky has a state income tax of 5%. • kentucky income tax payments currently due on april 15, 2020, may 15, 2020, and june 15, 2020 for individual, Web printable income tax forms. Utility gross receipts license tax; The current tax year is 2022, and most states will release updated tax forms between january and april of 2023. Taxformfinder provides printable pdf copies of 130 current kentucky income tax forms.

Web The 2021 Threshold Amount Is $12,880 For A Family Size Of One, $17,420 For A Family Of Two, $21,960 For A Family Of Three, And $26,500 For A Family Of Four Or More.

Kentucky income tax liability is not expected this year (see instructions) ̈ 2. Income gap tax credit—this credit has expired. Taxformfinder provides printable pdf copies of 130 current kentucky income tax forms. Web printable income tax forms.

The Current Tax Year Is 2022, And Most States Will Release Updated Tax Forms Between January And April Of 2023.

Web all kentucky wage earners are taxed at a flat 5% rate with a standard deduction allowance of $2,690. Utility gross receipts license tax; Please click here to see if you are required to report kentucky use tax on your individual income tax return. Kentucky has a state income tax of 5%.

The Department Of Revenue Annually Adjust The Standard Deduction In Accordance With Krs 141.081(2)(A).

• kentucky income tax payments currently due on april 15, 2020, may 15, 2020, and june 15, 2020 for individual, Tobacco and vapor products taxes; Web kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue. Web use tax on individual income tax return.

It Was Only Available For Tax Years 2019 And 2020.

The current tax year is 2022, with tax returns due in april 2023. Motor vehicle rental/ride share excise tax;