Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet - Vehicle expenses, such as tolls, parking, maintenance, fuel, registration fees, tires and insurance. Taxes and deductions that may be considered “ordinary and necessary” depends upon: Web truck driver tax deductions may include any expenses that are ordinary and necessary to the business of being a truck driver. Web the standard tax deduction stands at $12,550 for single people or married couples filing separately, $18,800 for head of household, and $25,100 for married couples filing jointly or surviving spouses. $153.00 per $1,000) before adjustment on the front of your 1040 tax return); With this form, you can track your mileage, fuel costs, and other expenses. Decide on what kind of signature to create. Form 2290 is used by truck driver and owner operator truck drivers to calculate their heavy highway use tax. It all depends on the type of business the trucking company is in and their vehicle operating expenses. Select the document you want to sign and click upload.

Free Owner Operator Expense Spreadsheet in Truck Driver Expenset

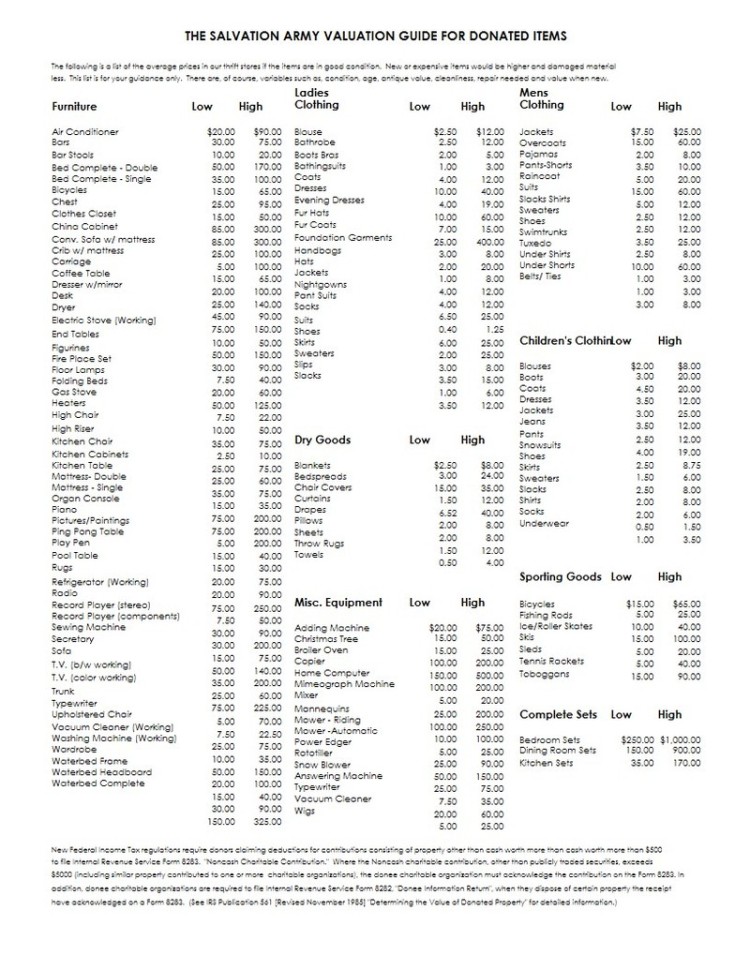

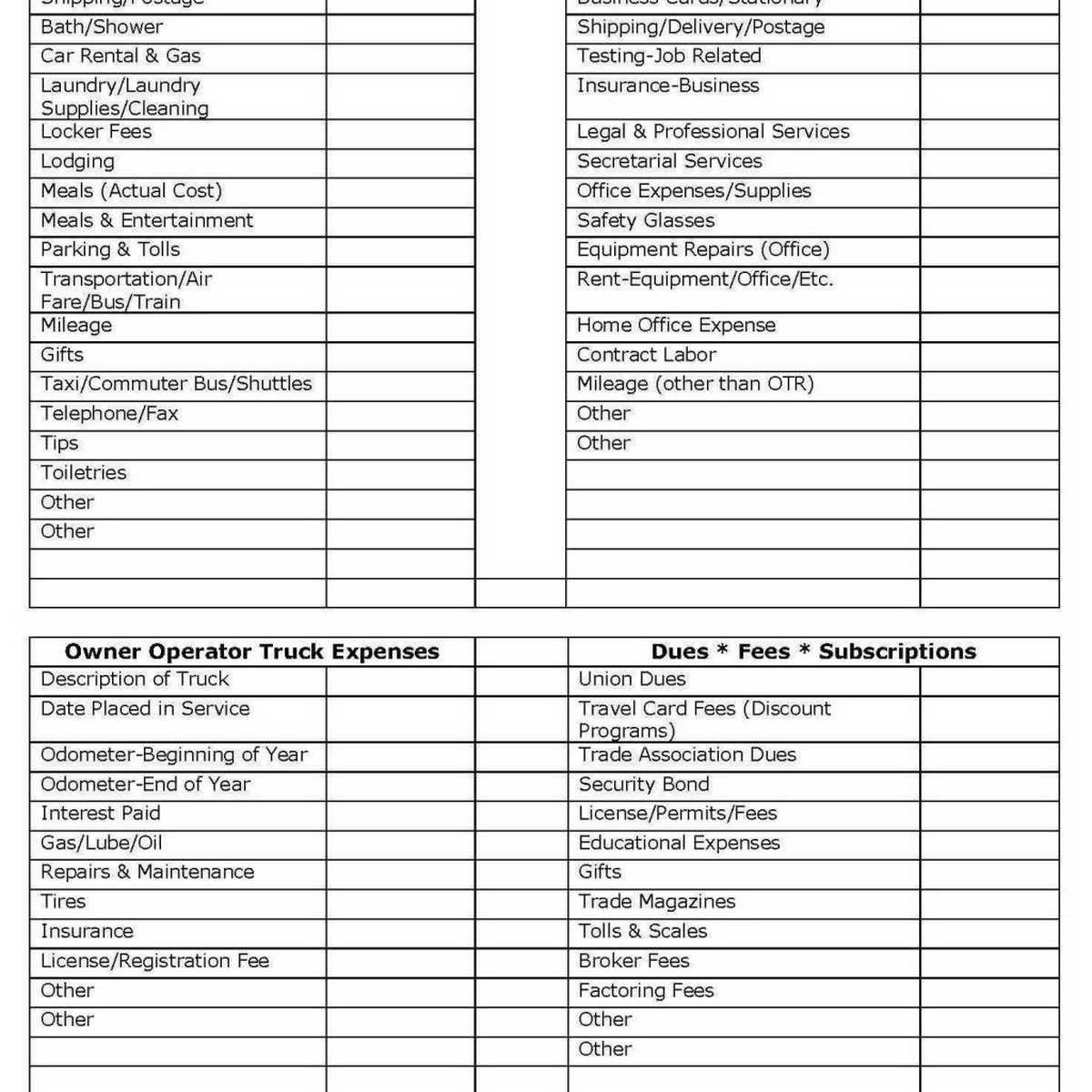

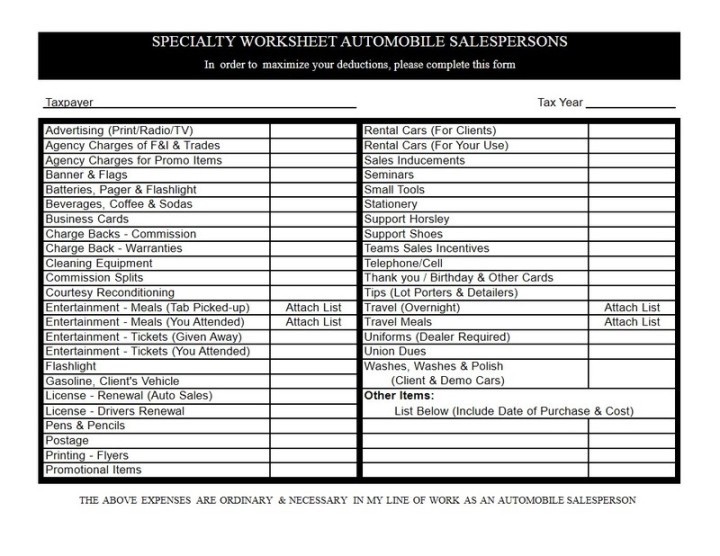

What the job is and what the expenses are for. 19 truck driver tax deductions that will save you money. Trade association dues or subscriptions to trade magazines. Car truck expenses (personal vehicle) ! Select the document you want to sign and click upload.

Truck Driver Expenses Worksheet ≡ Fill Out Printable PDF Forms Online

Web most truck driver pay about $550 dollar for heavy highway use tax. Web truck driver tax deductions may include any expenses that are ordinary and necessary to the business of being a truck driver. Approximately 90 percent of taxpayers use the standard deduction that increased significantly following the tax cuts and jobs act of 2017. Here’s a look at.

Truck Driver Profit and Loss Statement Template Tagua

Bonus depreciation allows companies to depreciate the full cost of a costly truck in one year, which helps business owners to invest in heavy vehicles for trucking business use. Get helpful information for truck driver taxes, deductions, truck depreciation, and tips for minimizing taxes. Keep track of what deductions you are taking advantage of. What the job is and what.

33 Truck Driver Tax Deductions Worksheet Worksheet Project List

Medical insurance premiums paid may be deductible! Download 2023 per diem tracker Web most truck driver pay about $550 dollar for heavy highway use tax. However on average, you can expect to spend between $50,000 and $70,000 each year filling up your truck. Approximately 90 percent of taxpayers use the standard deduction that increased significantly following the tax cuts and.

Owner Operator Expense Spreadsheet Google Spreadshee owner operator

Web truck driver tax deductions may include any expenses that are ordinary and necessary to the business of being a truck driver. Riviera finance november 10, 2022 no comments. Remember, you must provide receipts or other documentation. This means you need to keep accurate records of your deductions as well as your earnings. Travel expenses, if incurred while being away.

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

Web truck driver tax deductions are expenses that truck drivers can subtract from their taxable income to reduce their overall tax liability. Vehicle expenses, such as tolls, parking, maintenance, fuel, registration fees, tires and insurance. What the job is and what the expenses are for. Here’s a look at common deductions and business expenses truck drivers can claim on their.

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

Remember, you must provide receipts or other documentation. You can also download it, export it or print it out. Medical insurance premiums paid may be deductible! Web common tax deductions for owner operator truck drivers. Please visit the links below for more information:

Truck Driver Expense Spreadsheet Then Owner Operator —

However on average, you can expect to spend between $50,000 and $70,000 each year filling up your truck. If you don’t deduct all your expenses, you could. Web this truck driver expenses worksheet form can help make the process a little easier. Select the document you want to sign and click upload. Approximately 90 percent of taxpayers use the standard.

2020 Truck Driver Tax Deductions Worksheet Fill Online, Printable

However on average, you can expect to spend between $50,000 and $70,000 each year filling up your truck. Web common tax deductions for owner operator truck drivers. Kind of property date acquired date sold gross sales price expenses of sale original cost and ! Type text, add images, blackout confidential details,. Please visit the links below for more information:

Truck Expenses Worksheet Spreadsheet template, Printable worksheets

However on average, you can expect to spend between $50,000 and $70,000 each year filling up your truck. Web here is a list of some of the items you might be able to deduct: Taxes and deductions that may be considered “ordinary and necessary” depends upon: Type text, add images, blackout confidential details,. Web according to new tax laws for.

Web expenses or other data that might be deductible or required to be claimed elsewhere on a related tax form: What the job is and what the expenses are for. Type text, add images, blackout confidential details,. You can also download it, export it or print it out. Web the standard tax deduction stands at $12,550 for single people or married couples filing separately, $18,800 for head of household, and $25,100 for married couples filing jointly or surviving spouses. Bonus depreciation allows companies to depreciate the full cost of a costly truck in one year, which helps business owners to invest in heavy vehicles for trucking business use. Get helpful information for truck driver taxes, deductions, truck depreciation, and tips for minimizing taxes. Car truck expenses (personal vehicle) ! You'll use those 1099s, plus your own records of income and expenses, to report your trucking income and expenses on schedule c. Please visit the links below for more information: Trucker’s income & expense worksheet; Web truck driver tax deductions may include any expenses that are ordinary and necessary to the business of being a truck driver. Travel expenses, if incurred while being away from your tax base. Taxes and deductions that may be considered “ordinary and necessary” depends upon: Web forms that you should file as a truck driver depends on your type of employment: If you don’t deduct all your expenses, you could. Vehicle expenses, such as tolls, parking, maintenance, fuel, registration fees, tires and insurance. This means you need to keep accurate records of your deductions as well as your earnings. Kind of property date acquired date sold gross sales price expenses of sale original cost and ! Schedule a:various medical expenses, charitable contributions, unreimbursed employee business expenses, etc.

Web Truck Driver Expenses Worksheet.

You'll use those 1099s, plus your own records of income and expenses, to report your trucking income and expenses on schedule c. Interest paid on business loans; Web most truck driver pay about $550 dollar for heavy highway use tax. Web common tax deductions for owner operator truck drivers.

Some Trucking Companies Might Have Some Differences When It Comes To Truck Driver Tax Deductions Or Tax Breaks.

Printing out a copy of this form and keeping it with your receipts can help. Travel expenses, if incurred while being away from your tax base. Web trucker tax deduction worksheet our list of the most common truck driver tax deductions will help you find out how you can save money on your taxes! Web expenses or other data that might be deductible or required to be claimed elsewhere on a related tax form:

Taxes And Deductions That May Be Considered “Ordinary And Necessary” Depends Upon:

Get helpful information for truck driver taxes, deductions, truck depreciation, and tips for minimizing taxes. $153.00 per $1,000) before adjustment on the front of your 1040 tax return); Web according to new tax laws for truck drivers in 2023, truck driving companies have two options for a tax deduction for truck drivers: Medical insurance premiums paid may be deductible!

Trucker’s Income & Expense Worksheet;

Web this truck driver expenses worksheet form can help make the process a little easier. Vehicle expenses, such as tolls, parking, maintenance, fuel, registration fees, tires and insurance. Download 2023 per diem tracker Web truck driver tax deductions are expenses that truck drivers can subtract from their taxable income to reduce their overall tax liability.