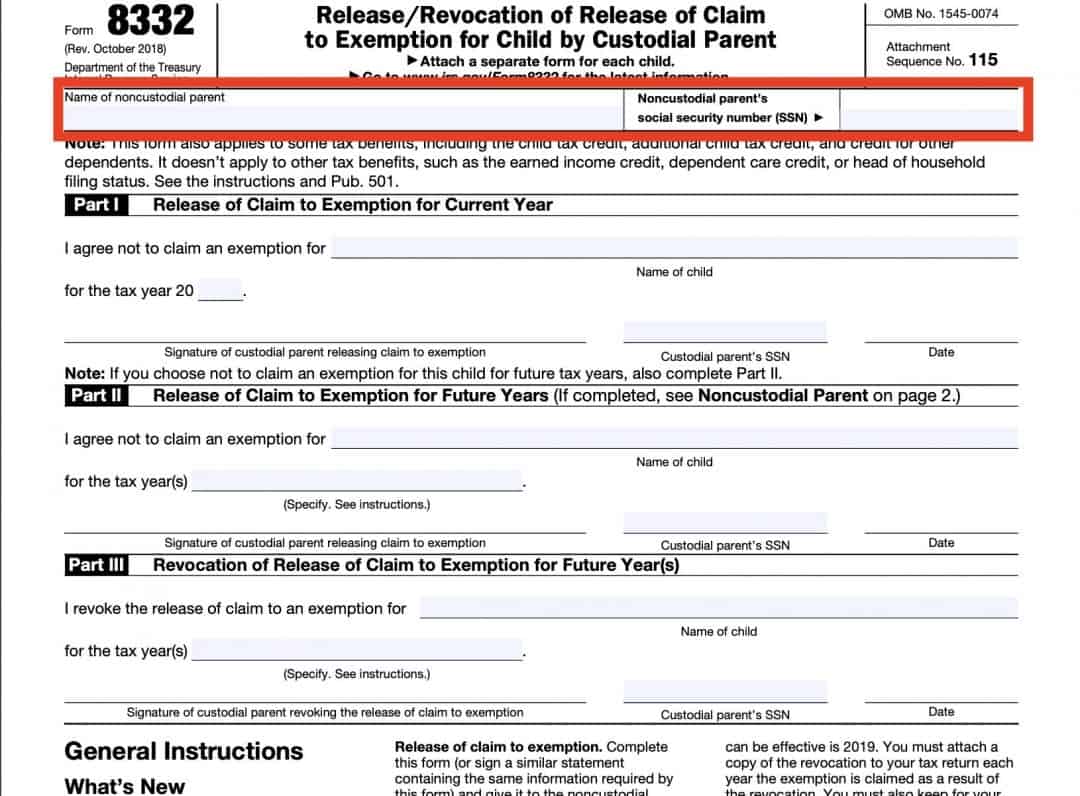

Tax Form 8332 Printable - Web if you are filing your tax return using an online provider, mail form 8453 to the irs within 3 business days after you have received acknowledgement from your intermediate service provider and/or transmitter that the irs has accepted your electronically filed tax return. Web irs form 8332 ≡ fill out printable pdf forms online home fillable pdf forms irs form 8332 irs form 8332 get form now edit fill out sign export or print download your fillable irs form 8332 in pdf table of contents who should fill out the document? Web where is form 8332? From within your taxact return ( online or desktop), click federal. Web form 8332 is used to release your child's dependency exemption and child tax credit benefit to the noncustodial parent, or revoke this permission, for specific tax years. The child is treated as having received over half of his or her total support from a person under a multiple support agreement (form 2120, multiple support declaration). We need it to ensure that you are complying with these laws and to allow us to figure and collect the right. An eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as: Instructions for form 941 pdf Web what is form 8332:

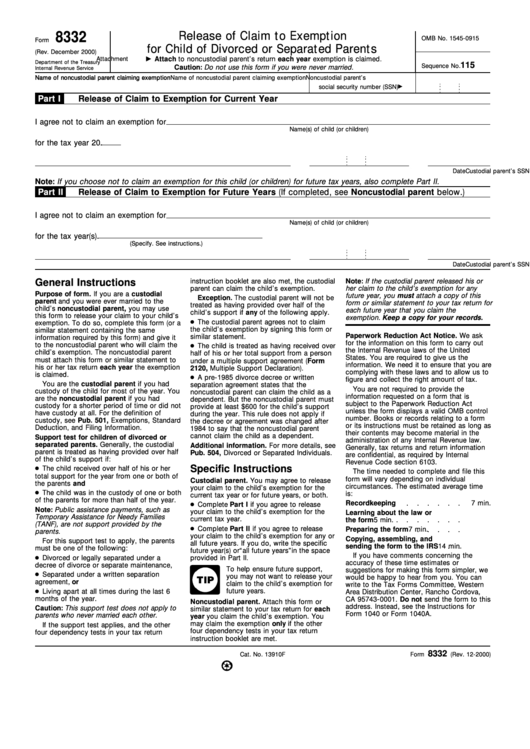

Child Tax Release Form f8332 Tax Exemption Social Security Number

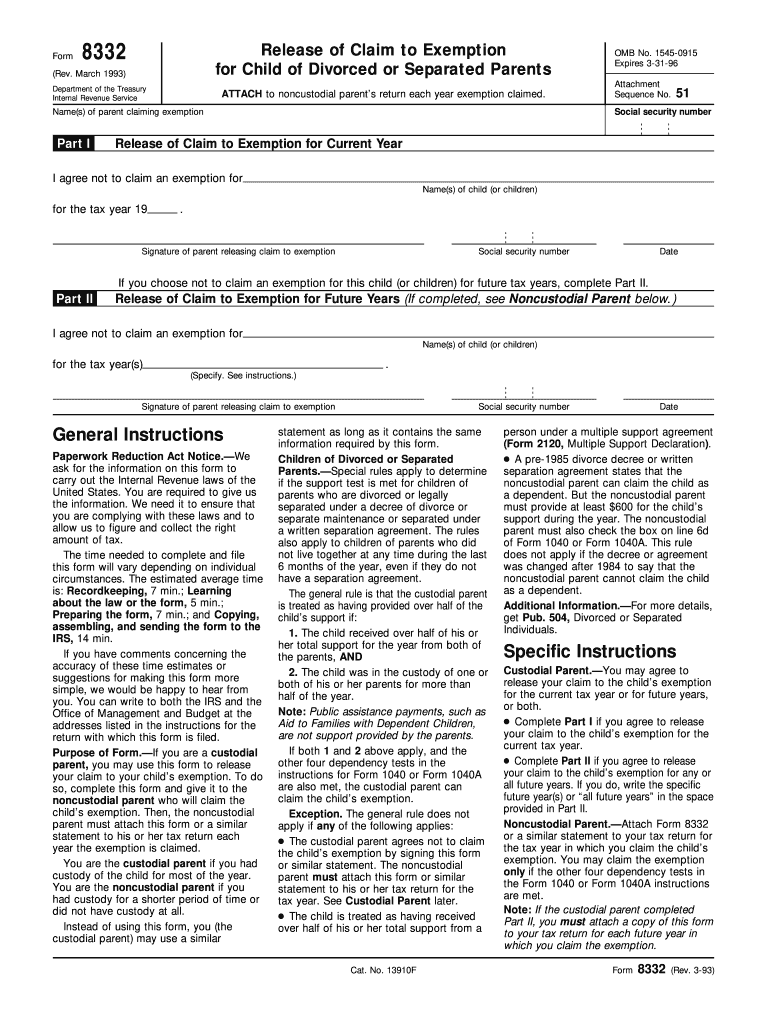

The form can be used for current or future tax years. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. An eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as: Web the child’s exemption.

Form 8332 Edit, Fill, Sign Online Handypdf

Edit your form 8332 online type text, add images, blackout confidential details, add comments, highlights and more. The form can be used for current or future tax years. Web the child’s exemption by signing this form or similar statement. Make entries in these fields: Web what is form 8332:

Printable Irs Forms 2021 8332 Calendar Printable Free

The child is treated as having received over half of his or her total support from a person under a multiple support agreement (form 2120, multiple support declaration). You are required to give us the information. Web what is form 8332: Web irs form 8332 ≡ fill out printable pdf forms online home fillable pdf forms irs form 8332 irs.

Printable Irs Forms 2021 8332 Calendar Printable Free

Make entries in these fields: Open the doc and select the page that needs to be signed. Web employer's quarterly federal tax return. Print, sign, and distribute to noncustodial parent. Web form 8332 is used to release your child's dependency exemption and child tax credit benefit to the noncustodial parent, or revoke this permission, for specific tax years.

IRS 8332 20182022 Fill and Sign Printable Template Online US Legal

Web form 8332 is a tax form issued by the internal revenue service (irs) that is used to release a claim to exemption for a child. From within your taxact return ( online or desktop), click federal. You can print other federal tax forms here. This file should not be sent directly to the irs but to the other parent..

Is IRS tax form 8332 available online for printing? mccnsulting.web

Web get tax form 8332 printable signed right from your smartphone using these six tips: Release/revocation of release of claim to exemption for child by custodial parent written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 08:59 am overview having custody of your child usually means you can claim.

Printable Irs Forms 2021 8332 Calendar Printable Free

The child is treated as having received over half of his or her total support from a person under a multiple support agreement (form 2120, multiple support declaration). Additionally, custodial parents can use tax form 8332 to. This file should not be sent directly to the irs but to the other parent. Print, sign, and distribute to noncustodial parent. Employers.

IRS 8332 1993 Fill out Tax Template Online US Legal Forms

Web form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Delete the data entered in screen 70, release of claim to exemption (8332) to prevent the form 8453 from generating. Print, sign, and distribute to noncustodial parent. We need it to ensure that you are complying with these laws and to allow.

IRS Form 8332 A Guide for Custodial Parents

Search for the document you need to electronically sign on your device and upload it. The tax form 8332 printable is a short document that only takes up half a page. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right. Share your form with others send form.

Fillable Form 8332 Release Of Claim To Exemption For Child Of

Web form 8332 is a tax form issued by the internal revenue service (irs) that is used to release a claim to exemption for a child. From within your taxact return ( online or desktop), click federal. Share your form with others send form 8332 fillable via email, link, or fax. Permission can also be granted for future tax years.

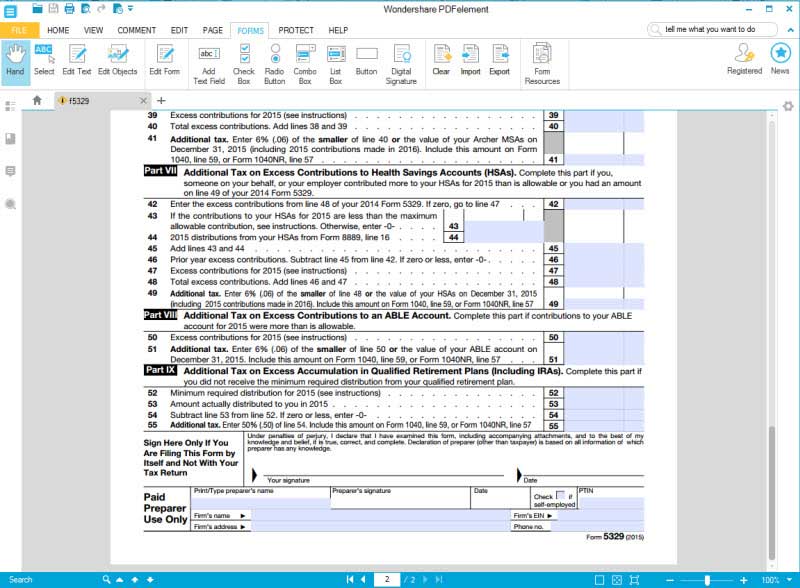

Instructions for form 941 pdf Taxformfinder has an additional 774 federal income tax forms that you may need, plus all federal income tax forms. Delete the data entered in screen 70, release of claim to exemption (8332) to prevent the form 8453 from generating. This file should not be sent directly to the irs but to the other parent. Edit your form 8332 online type text, add images, blackout confidential details, add comments, highlights and more. We ask for the information on this form to carry out the internal revenue laws of the united states. Type signnow.com in your phone’s browser and log in to your account. An eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as: Release/revocation of release of claim to exemption for child by custodial parent written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 08:59 am overview having custody of your child usually means you can claim that child as a dependent on your taxes. The tax form 8332 printable is a short document that only takes up half a page. Share your form with others send form 8332 fillable via email, link, or fax. Web form 8332 is used to release your child's dependency exemption and child tax credit benefit to the noncustodial parent, or revoke this permission, for specific tax years. Web what is form 8332: Web irs form 8332 ≡ fill out printable pdf forms online home fillable pdf forms irs form 8332 irs form 8332 get form now edit fill out sign export or print download your fillable irs form 8332 in pdf table of contents who should fill out the document? Open turbotax sign in why sign in to support? If you are the custodial parent, you can use form 8332 to do the following. Web form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Web employer's quarterly federal tax return. Special rule for children of divorced or separated parents a child is treated as a qualifying child or a Name of noncustodial parent claiming exemption release of claim to exemption for current year i agree not to claim an exemption for for the tax year 20.

About Form 8332, Release/Revocation Of Release Of Claim To Exemption For Child By Custodial Parent | Internal Revenue Service

The form can be used for current or future tax years. Make entries in these fields: A form 8332 is designed specially for the custodial parent who want to release the right of custody of his/her child and claim it exemption to the noncustodial parent, as well as revoking a previous release of claim to exemption for your child. Print, sign, and distribute to noncustodial parent.

Web Form 8332 Is Used To Release Your Child's Dependency Exemption And Child Tax Credit Benefit To The Noncustodial Parent, Or Revoke This Permission, For Specific Tax Years.

Name of noncustodial parent claiming exemption release of claim to exemption for current year i agree not to claim an exemption for for the tax year 20. Purpose of the document how to fill out a document Instructions for form 941 pdf Edit your form 8332 online type text, add images, blackout confidential details, add comments, highlights and more.

Web Prepare The Form 8332 On The Custodial Parent's Return.

Special rule for children of divorced or separated parents a child is treated as a qualifying child or a If you are the custodial parent, you can use form 8332 to do the following. Web the child’s exemption by signing this form or similar statement. Delete the data entered in screen 70, release of claim to exemption (8332) to prevent the form 8453 from generating.

We Ask For The Information On This Form To Carry Out The Internal Revenue Laws Of The United States.

It is usually used when a parent wants to release a claim to exemption for a child that they are entitled to on their tax return, so that the other parent can claim the child as a dependent. Web employer's quarterly federal tax return. You can print other federal tax forms here. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad.